Cross border e-commerce 2022: supply chain and logistics bring continuous challenges, and emerging markets contain new opportunities

The following article is from gPLP. The author thinks that the flat ground grows ten thousand feet high

Source /gplp (id:gplpcn)

Author /jeff

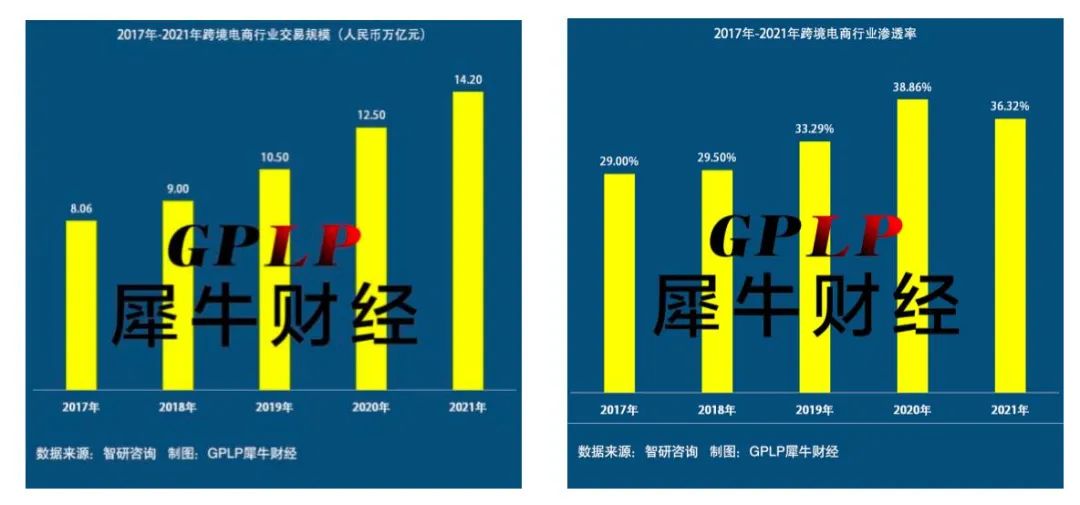

Cross border e-commerce refers to an international business activity in which trade subjects belonging to different customs territories use the Internet trading platform to initially form a transaction intention, then carry out capital payment and settlement, and finally complete the delivery of goods and services through cross-border logistics. In the context of the global epidemic, cross-border e-commerce still ushered in a short outbreak period. According to the relevant report of Zhiyan consulting on China's cross-border e-commerce market, in 2020, the transaction scale of China's cross-border e-commerce industry was 12.5 trillion yuan, a year-on-year increase of 19.05%; In 2021, the transaction scale of China's cross-border e-commerce industry was 14.2 trillion yuan, a year-on-year increase of 13.6%. In 2021, although the operation of many cross-border e-commerce enterprises was damaged, the industry penetration rate still reached 36.32%.

In 2022, the impact of the epidemic will be superimposed on the increasing uncertainty in the supply chain, and global energy and shipping prices will remain high. What are the challenges and opportunities facing cross-border e-commerce?

01

Continuous challenges brought by supply chain and logistics

Compared with domestic e-commerce, cross-border e-commerce has a longer supply chain, involving procurement and supply, logistics distribution, customs clearance, electronic payment, after-sales service and other links. Any problem in any link will affect the overall situation.

There are two major cross-border e-commerce supply chain logistics events worthy of attention in 2021:

The first is that Amazon has set up a warehouse in Yiwu to receive goods directly;

The second is a series of actions that Maersk directly connects with big B customers through freight forwarders.

As a mainstream e-commerce platform with a large amount of traffic, Amazon will end up in person and directly control the supply chain and logistics delivery to form a closed-loop system. Is it an expedient under the epidemic or a general trend in the future?

Will major e-commerce platforms learn from Amazon and, after the platform traffic is large enough, in order to ensure delivery experience and supply chain security, build their own logistics system and directly connect with upstream and downstream key resources, so as to directly control the end-to-end business of the whole process?

If the above situation occurs, what fate will various cross-border e-commerce traders and logistics service providers in the current market face?

Through this phenomenon, we find that in all links of cross-border e-commerce, supply chain and logistics are undoubtedly the top priorities.

According to Kunal Chopra, CEO of kaspien, the most professional music and video retailer in the United States, "The supply chain problems faced in 2021 will still exist at least in the first half of 2022. The competition of cross-border e-commerce has shifted from sales to competition in the supply chain. Key elements such as demand insight and cost control in the procurement process are becoming difficult. At the same time, the contradiction between supply and demand is becoming more and more prominent due to the requirements of timeliness, security and compliance. The coordination and integration of cross-border e-commerce supply chain has become particularly important."

Industry insiders agree that logistics is the core chain of the development of cross-border e-commerce, and it is also the main bottleneck restricting the development of cross-border e-commerce at present - relevant data show that the cost of cross-border e-commerce logistics generally accounts for 20%-30% of the transaction volume in the whole cost of cross-border e-commerce, while the cost rate of domestic e-commerce logistics is only within 5%.

After the outbreak of the epidemic, the cost of cross-border e-commerce logistics is ridiculously high with the continuous rise of shipping prices. In the more than 10 years before 2019, the sea freight for a 40 foot standard container to be transported from China to the western United States will be about $2000. However, in the past two years, the price has risen to 20000 US dollars. At the same time, because the supply exceeds the demand, we still need to "grab".

In the first four months of 2022, although the sea freight dropped from the peak of US $18000 to about US $8000, it is still four times higher than US $2000. At the same time, many people who are engaged in cross-border e-commerce believe that the sea freight also fell sharply last year, but it soon rose again, and this year the probability will repeat the same mistakes.

In addition to the soaring freight, cross-border e-commerce is facing more severe logistics problems in emerging markets. These markets are limited by their own development stage and construction level. In terms of logistics, they generally have the problems of few flights, difficult customs clearance and last mile distribution. Compared with mature European and American markets, they are relatively inefficient and cost more.

Industry insiders believe that building a high-level overseas warehouse is an effective way to solve logistics problems, but the huge cost behind the overseas warehouse can not be ignored, because the construction of overseas warehouse not only needs to pay expensive storage costs, but also the difference in scale and information service capacity will produce different results. If the comprehensive service capacity is not efficient, it is difficult to balance the cost and benefit of the overseas warehouse.

In addition to the biggest dilemma in supply chain logistics, cross-border e-commerce is also facing the dilemma of brand building and platform operation mode selection - with consumers placing more emphasis on the pursuit of product quality, the advantage of competing for the market with "quantity" and "price" is gradually fading, and brands are playing an increasingly important role in cross-border e-commerce. Enterprises have also begun to pay attention to brand building, through the brand premium to enhance the added value of commodities, commodity exports will tend to be high-quality and brand.

According to the statistics of the General Administration of customs, in the whole cross-border e-commerce export in 2021, only 17% of the goods with their own brands, which is far from the overall scale of cross-border e-commerce in China. Most products are still limited to Shanzhai and processing, and the brand influence is not high on the whole. From the perspective of export commodities, clothing and footwear are mostly primary processed commodities, while high value-added products account for a relatively low proportion.

It is not difficult to see that the brand building of China's cross-border e-commerce is still relatively weak, and brand building and communication is still a challenge for most cross-border e-commerce. If e-commerce enterprises cannot build their own brands, they will easily fall into the dilemma of homogenization and price war.

At present, the operation modes adopted by cross-border e-commerce mainly include the third-party platform mode and the independent station mode. With the increasingly stringent supervision of the seller by the third-party platform, the independent station mode is expected to accelerate its development.

The advantage of the independent station mode is that businesses have a high degree of autonomy and are not squeezed and restricted by the platform. At the same time, businesses can collect and analyze customer information for subsequent selection and marketing, and gradually form their own customer groups. However, the disadvantages of independent stations are also very obvious, that is, the cost is high, which is not only reflected in the station construction cost, but also includes the traffic cost.

Compared with the self-contained traffic of the third-party platform, independent stations can only rely on independent drainage. However, as the media resources are almost monopolized by several giants, the traffic cost is always high. Under the condition that the traffic cost continues to be high, the independent station is under great pressure to survive. At the same time, the creation of an independent station requires not only the operation of commodities but also the operation and maintenance of the platform, which puts forward very high requirements for enterprise operation.

02

Emerging markets represented by Southeast Asia usher in new opportunities

The trade market plays an important role in cross-border e-commerce, and promoting the diversification of trade market is the general trend. North America and Europe are the main battlefields of cross-border e-commerce, with more than half of enterprises entering these two regions.

However, with the rise of trade protectionism in developed countries and the accelerated return of manufacturing, the growth space of the two major markets in Europe and the United States is being continuously compressed, and the development of more trade markets has become the top priority of cross-border e-commerce.

With the promotion and implementation of the "the Belt and Road" initiative, domestic cross-border e-commerce enterprises have welcomed opportunities. We began to vigorously explore the markets of countries and regions along the "the Belt and Road" such as Southeast Asia, Central Asia and central and Eastern Europe, and expanded our distribution to emerging countries and regions such as Africa and Latin America. Driven by the "going global" of enterprises and the signing of RCEP agreement, emerging markets represented by Southeast Asia are becoming an important part of China's cross-border e-commerce trade market.

Relevant institutions predict that the total e-commerce sales in Southeast Asia is expected to reach US $89.67 billion in 2022, with a year-on-year increase of 20.6%, making it a region with a high growth rate in the world. It is estimated that by 2025, the e-commerce market in Southeast Asia will reach US $234billion.

Apart from Singapore, the proportion of e-commerce retail in Southeast Asian countries is relatively low compared with the Internet penetration rate. Compared with China's mature e-commerce market, the e-commerce market in Southeast Asia has great potential. At present, the proportion of e-commerce in the total retail sales of social goods in Southeast Asia is less than 3%, which is far from 23% in China. Seizing the first opportunity has been an opportunity for many cross-border sellers to develop the Southeast Asian market.

For China's cross-border e-commerce going to sea, the formal entry into force of the regional comprehensive economic partnership agreement (RCEP) has further opened up the Southeast Asian market.

Liubingyu, researcher of the Russian Center of Sanya University, summarized in the current situation of cross-border e-commerce cooperation between China and Southeast Asian countries that the important cross-border e-commerce platforms in Southeast Asia include:

Lazada:

Laizanda is one of the largest online shopping websites in Southeast Asia, mainly engaged in electronics, home furnishings, clothing, sports equipment and other products. Alibaba is its shareholder;

Shopee:

Southeast Asia and Taiwan, China lead the e-commerce platform, covering seven markets, including consumer electronics, home furnishings, beauty care, mother and baby, clothing and fitness equipment. The platform has its own logistics SLS, which has been fully launched in Singapore, Malaysia, Philippines, Indonesia, Thailand, Vietnam and Taiwan, China.

Other e-commerce:

Other e-commerce companies currently include tokopedia, Amazon, zalora (one of the fastest growing e-commerce companies in Southeast Asia, with more than 500 brands settled), ezbuy (one of the largest e-commerce platforms for all category shopping and retail in Southeast Asia, with commodities mainly from China, the United States, South Korea and other countries), etc.

By 2021, Chinese capital has been deployed in Southeast Asia. Alibaba has invested in lazada, tokopedia and bukalapak, Tencent has invested in shopee platform, and JD central and Tiki platforms.

Many small and medium-sized cross-border e-commerce enterprises in China generally prefer the above platforms to open online stores. Such overseas cross-border e-commerce platforms have also introduced and improved more complex operating rules.

Therefore, when developing markets in Southeast Asia, cross-border e-commerce will inevitably conflict with the current traditional trade regulatory rules system of Southeast Asian countries and the regulatory rules system for the operation of overseas cross-border e-commerce platform enterprises. Therefore, cross-border e-commerce must pay attention to compliance when going to Southeast Asia?

In this regard, fengxiaopeng, a partner of Jindu law firm, pointed out that for China's cross-border e-commerce, although the official entry into force of RCEP has further opened up the Southeast Asian market, more and more cross-border e-commerce businesses are pouring into the Southeast Asian market, which will promote the local government to gradually formulate and improve relevant support and regulatory policies for cross-border e-commerce.

Chinese cross-border e-commerce enterprises should further improve their ability to "do as the Romans do", actively pay attention to the formulation and implementation of national regulatory policies in Southeast Asian target markets, and timely build a legal and compliant business model to avoid blind business.

The large demographic dividend of Southeast Asian countries, the growing economy, high investment in the digital economy, and the comprehensive popularization of mobile devices have all built a huge market volume foundation for cross-border e-commerce in Southeast Asia. However, the supporting weakness of e-commerce market in Southeast Asia is also very obvious. In particular, logistics is difficult to meet the logistics service requirements for cross-border e-commerce goods export of both parties. Except Singapore, the overall logistics level of Southeast Asian countries is low, and the efficiency of logistics distribution is poor, especially in the last kilometer.

In 2022, cross-border e-commerce will still face the challenge of rising supply chain and maritime logistics prices. At the same time, the opening of emerging markets has also brought new opportunities for cross-border e-commerce enterprises. Exporting to Southeast Asia is one of the choices that brands cannot miss when going to sea. With the entry into force of RCEP, the world's most potential free trade zone has officially opened a rapid development mode. For cross-border e-commerce enterprises, they can enjoy the double dividends brought by free trade rules and national policies. In addition to the development of Internet information technology, China's cross-border e-commerce enterprises are bound to usher in a new round of vigorous development in Southeast Asia.

Source /gplp (id:gplpcn)

Author /jeff