King of food supply chain: annual sales of 50 billion US dollars, business in 90 countries

Source / business (ID: shangjie-1994)

Author / Chang Jin

In 2022, the physical stores struggled to survive, but the supply chain companies behind them were lining up for listing.

First, at the beginning of the year, Baoli food, the seasoning company behind Xi tea, McDonald's and KFC, planned to be listed on the main board of the Shanghai Stock Exchange; Subsequently, Hefei Hengxin Life Technology Co., Ltd., the packaging material supplier behind Ruixing and Xi tea, also disclosed the prospectus.

For a time, the value of supply chain companies was exposed to the spotlight.

The layman watches the bustle, while the layman watches the doorway. The value of supply chain companies has long been self-evident to people in the industry. All catering enterprises on a large scale strive to grow into supply chain companies and hope to become China's "Cisco".

Who is Cisco?

Since fortune released the world's top 500 enterprises in 1995, Cisco has been listed in the list for 27 consecutive years and has been ranked in the top 200 for nearly six years. As the world's largest food supply chain company, it has been repeatedly "deified" by the supply chain market.

Inspired by Sisco, Zhang Yong, founder of Haidilao, founded Shuhai; Wang Xing of meituan saw the unlimited potential of Cisco and founded Kuaiyu; Liu Chuanjun, CEO of meicai.com, has repeatedly expressed in public that he wants to benchmark the Cisco model; SF acquires the business of havi China, a cold chain service provider of McDonald's, and directly targets Cisco

They are all trying to tell the story of a Chinese version of Cisco, but so far, Cisco is still an unattainable dream for them.

01

Rising road

In 1969, John F. Baugh founded Cisco in Houston, opening a road of regional integration, continuous M & A and deep market exploration.

John F. Baugh is an explorer of the food supply chain market in the United States. As early as 1940, he began to do the business of quick-frozen food distribution; In 1946, he and his wife EULA Mae founded zero foods to deliver frozen food to hotels, hospitals, schools and restaurants in Houston, Texas.

John has been involved in the supply chain industry for 23 years, and the background of the time allows him to find greater business opportunities:

First, in 1945, after the end of World War II, the war supply chain was commercially available; Second, after 1956, the United States built interstate highways on a large scale, and the logistics capacity developed rapidly. Small shops began to decline. Large supermarkets and chain restaurants sprang up like bamboo shoots. Wal Mart rose at that time.

The times and the industry are changing. John is worried that after the transportation is convenient, catering enterprises will definitely choose to purchase by themselves. In this way, the market space of zero foods will be occupied. However, he also saw that the food distribution system in the United States includes a large number of small local enterprises, but there is no national food supplier. He believes that if a large national group can be established, food can be distributed in the covered area, and then competitors in other places can be defeated by scale.

So John persuaded small food suppliers in eight other large agricultural states to establish Sysco in 1969.

Cisco has created a business model driven entrepreneurial myth. In the first year of its establishment, the total sales reached US $115 million; The following year, Cisco was listed on the New York Stock Exchange.

The construction of food supply chain needs a lot of money and takes a long period. Compared with the operation and development of other industries, it is more like a marathon.

The shareholders of the nine companies exchanged their shares for Cisco's common shares, and Cisco quickly entered the capital market and received more capital supply from the secondary market.

Cisco was very beautiful from the start of the marathon.

02

M & A

After the listing, Cisco immediately embarked on a shocking road of mergers and acquisitions.

According to the analysis of Jingwei venture capital, its M & a strategy is mainly divided into two parts:

First, regionally, through M & A, we will expand horizontally and acquire in different regions to increase market share;

Second, in the industry, we will seize the added value nodes in the industrial chain through mergers and acquisitions, and continue to extend to the upstream to enhance our control over the industrial chain and business added value.

Figure source: Jiucheng industry research and arrangement

Looking back at the development history of Cisco, we can call it the trilogy of "external expansion, internal generation and diversification".

In 1970, Cisco acquired arrow food distributor, a distribution company specializing in baby food and fruit juice; In 1976, mid central fish and Frozen Foods Inc., which is engaged in the distribution of frozen meat, poultry, seafood, fruits, vegetables, canned and dried products and paper, was acquired, adding many agricultural products to Cisco, especially fresh products that are not affected by the cycle.

These mergers and acquisitions have laid a foundation for the distribution of basic food in Cisco, and Cisco's national distribution capacity has been greatly improved.

In 1981, Cisco became the largest food supplier in the United States. It began to provide meat and frozen main dishes for supermarkets and other customers, breaking the product category dominated by standard products in the early days of its establishment.

Figure source: Jiucheng industry research and arrangement

By the end of the 1980s, Cisco had completed 43 mergers and acquisitions, and through mergers and acquisitions, it had opened up most regions of the American market. By this time, Cisco had basically completed the national layout, which was also its national layout, dispersing market risks and preventing it from the economic crisis in the 1980s.

In 1989, Cisco's annual sales reached 6.85 billion US dollars, twice that of the second place, accounting for 8% of the fresh food supply market in the United States. After that, it began to extend to the upstream industry. In 1990, it acquired Scrivner Inc. of Oklahoma and began to provide distribution for the large chain retail market; In 1999, it acquired upstream meat enterprises, such as Newport meat, which makes cooked steak, and Buckhead beef company, which makes customized and refined segmentation, and began to expand vertically and horizontally.

Entering the millennium, Cisco officially entered the international market.

In 2001, Cisco acquired guest supply, specializing in hotel customers;

In 2003, it acquired Asian foods, the largest Asian food distributor in North America, specializing in Asian restaurants and Asian ingredients;

In 2009, it acquired Pallas foods, the largest food distributor in Ireland;

In 2016, it acquired the British peer giant brakes group with us $3.1 billion and quickly entered the European market

By the end of 2018, Cisco had acquired 198 companies.

Cisco's frequency of mergers and acquisitions is 3.8 on average every year. However, it is admirable that under such rapid expansion, the company's gross profit rate is extremely stable: from 1987 to 2017, Cisco's gross profit rate always fluctuated between 18% - 20%. On the one hand, there is no increase in cost due to the expansion of scale, resulting in a significant decrease in gross profit rate; On the other hand, there is no obvious increase in returns to scale and a sharp increase in gross profit rate due to the expansion of scale.

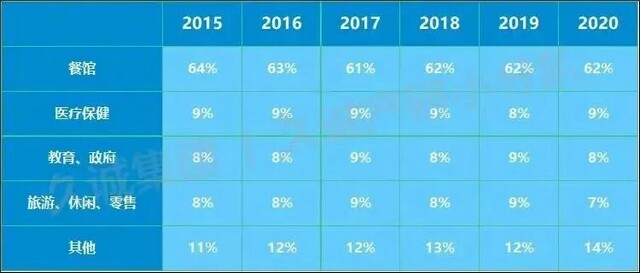

According to the analysis of industry insiders, the main reason is that there are market reasons. The chain rate of American catering enterprises is high. In 2019, the chain rate in the United States reached 59%. In addition, the chain enterprises are large in scale and have strong bargaining power. It is easy to form a buyer's market and occupy the profit space of upstream suppliers.

"For about 30 years from 1992 to now, every time its income reaches the bottleneck, M & A has become a new driving force for growth."

03

Winning Road

It is generally accepted in the industry that the profit of enterprises to B is meagre and it is not easy to make profits.

Looking back on the development history of Cisco, which is also the development history of the food supply chain industry in the United States, Cisco has always followed the development of the food supply chain in the United States by relying on mergers and acquisitions.

During the period when the overall growth rate of the industry was the fastest, Cisco accelerated the speed of mergers and acquisitions to expand; When the growth rate slows down, cultivate internal skills; After the United States became stable, it began the road of globalization.

In addition to the opportunities given by the times, Cisco's success also has its own winning treasure.

1. Self built logistics and acquisition dual operation, with perfect supply chain mechanism.

Cisco adopts two methods in logistics layout: self built logistics and acquired heavy asset operation.

As mentioned earlier, in 1981, Cisco became the largest food distribution company in the United States. In 1988, Cisco acquired CFS Continental, the then third-largest food distribution company in the United States, making it very strong in logistics and distribution.

In order to meet the downstream requirements for food safety and fast and accurate performance, Cisco has adopted a folding expansion strategy to establish a logistics system, that is, to establish a new independent operation center far from the original logistics center to effectively improve the logistics distribution density.

It is through the huge logistics system that Cisco can realize the rapid response of the supply chain - distribution at any time and emergency distribution, and can select the best route among multiple distribution schemes to optimize the logistics cost. These logistics and distribution facilities distributed in various regional centers are the direct entrance for Cisco to approach customers, serve customers, and transfer ideas.

At the end of 2018, Cisco had 332 logistics centers and 14000 logistics transport vehicles, of which 78% of storage facilities and 88% of logistics transport vehicles were owned by Cisco. In 2017, the number of distribution centers and logistics vehicles increased by 25 and 3200 respectively, mainly due to the acquisition of European food supplier brakes.

It can not be ignored that warehousing logistics has scale effect. With the increase of business volume, Cisco's warehousing logistics efficiency continues to improve, and the distribution cost also decreases accordingly.

2. Review and monitor the whole process and control the product quality.

In the United States, if a food company can become a supplier of Cisco, it is equivalent to being highly recognized. This is due to Cisco's long-standing reputation in product quality control.

To become a Cisco supplier, you must go through a series of strict standard review processes. Cisco has established a quality inspection team composed of about 196 full-time enterprise employees and 35 contracted inspectors, which is specially responsible for quality monitoring, including food material collection, storage, processing, transportation and other links to ensure food safety.

All suppliers must pass the audit managed by Cisco QA (quality assurance) to assess their food safety, production process, employee health, quality management system, adequacy and traceability of recalls, etc.

Take Sysco / freshpoint as an example. Sysco / freshpoint is the largest distributor of food and beverage products in North America, which is wholly owned and operated by Cisco. It can provide a variety of services from staple foods, fruits and vegetables to local specialties. Its products are famous for their superior quality, and the planting, packaging, processing and transportation standards of food materials exceed the "American # 1 quality grade standard".

In addition, Cisco also has a set of strict and perfect management system, which provides unified guidance and arrangement for the supplier's product packaging design, business management tracking, employee training, etc., so as to optimize the supplier's product and management level and improve Cisco's supply efficiency.

3. Fine supporting value-added services.

Compared with other supply chain enterprises in the market, Cisco's price is moderate, but it provides supporting value-added services. This is similar to the emerging e-commerce SaaS: seeking cooperation by providing customers with complete solutions.

When the new restaurant is ready to build a restaurant, Cisco will provide free dish design service, as well as optional cashier system, menu design service and stand management system; Each branch will be equipped with kitchen and chef cooking design services, and free teaching; For restaurants that are in continuous operation, Cisco will provide regular repeat service for restaurants.

Driven by a rich variety of products and corresponding supporting services, Cisco occupies 18% of the US food supply chain market.

4. Efficient delivery rate.

Cisco has more than 10000 trucks departing from the warehouse every day, and more than 1.8 billion orders are delivered every year. Each warehouse can deliver up to 50000 orders to customers every day. These orders all depend on the company's powerful IT system, which can process a large amount of information in a short time, accurately match the goods, trucks, warehouses, distribution points, etc., and ensure that these large trucks leave on time without any delay.

Take Cisco's branch in San Diego as an example. It is a warehouse covering an area of 4000 square meters, storing 12000 goods, covering three temperature zones of dry goods, cold storage and freezing. The logistics radiation is 100 miles, serving 2000 active users.

In order to improve the efficiency of storage and shipment, all the incoming goods of the company's suppliers, even fresh ones, are standardized products packed in cartons, packed one by one, and directly moved in whole batches by forklift without manual handling. These products are sent to the warehouse, and the staff will scan the goods and location codes to ensure their one-to-one correspondence.

When a customer has a special order, Cisco will feed back to the acquired segmentation Center for special treatment according to the customer's requirements. During delivery, the customer will deliver the store key to Cisco. If it is in the early morning, the driver will directly deliver the goods to the store according to the customer's time and storage requirements. All orders are completed within 24 hours, and the error is within 2 hours.

In addition, Cisco's IT system will make sales forecast and inventory turnover forecast to ensure that 400000 SKUs will not be stored for too long. Even if the turnover rate is very low, the inventory will be circulated once a week.

In the face of such a large number of orders, server failure and downtime are always inevitable. In 2015, Cisco became the first company in the world to use an intelligent system to solve this problem - the system can automatically handle tens of thousands of server failures every month, reducing the accident rate of Cisco by 89%; The server downtime per month was reduced by 40000 hours; The repair time for serious faults has changed from 19 hours to 18 minutes.

All these are the core competitiveness of Cisco.

It is worth mentioning that as of July 2021, Cisco has about 58000 employees, with businesses in 90 countries around the world. Cisco has chosen the localization strategy. Each warehouse has its own "self-management". It operates independently internally and continuously optimizes the operation process and efficiency, thus maximizing the benefits. Within Cisco, a knowledge base of BBP (best business practices) best business practices has been established. Cisco employees can share and find good experiences to solve a certain problem here.

Today, Cisco has customers in 90 countries around the world. In 2021, Cisco's annual sales reached US $51.3 billion, providing products and related services to more than 650000 customer locations. Cisco is everywhere in restaurants, hotels, hospitals, schools and other places.

Looking back at the Chinese market, the fire of prefabricated vegetables this year is actually a link in the food supply chain. Looking at the essence through the phenomenon, the fire of prefabricated vegetables is only a signal. The era of great development of China's food supply chain may be beginning. Cisco has set a benchmark.

Some data sources

"The year after its establishment, it went public, acquired 198 companies, and established a global supply chain... How did Sysco do it?" / Matrix Partners

Interpretation of Sysco: as a B2B restaurant, why do you ride on the same horse Li Chengdong

Sysco's "jungle law" / new eyes, coral

Source / business (ID: shangjie-1994)

Author / Chang Jin