Depth: why does HEMA have to fight the supply chain?

Source / xinmou (id:xinmouls)

Author / LAN Binsheng

After the first half of the new retail, which rushed to change its scale at the cost of its life, HEMA seemed to begin to deliberately turn its course.

Three years ago, when asked by the media about "what is the core competence of HEMA", Hou Yi, founder of HEMA, replied that "HEMA's biggest ability now is to iterate continuously, see what peers do well, and learn from it." In fact, it is true that adhering to the principle of "loss is not important, the key is to get the model through", HEMA has frequently tried new formats in the past few years, and is only willing to give a very short verification cycle, which is best reflected in the three formats of HEMA station, HEMA mini and HEMA neighborhood.

This is not a problem for the HEMA family. Compared with other fresh food players in the market, whether it is Ding Dong shopping and daily fresh food in the front warehouse mode, or meituan preference and more vegetables in the community group buying mode, they are all familiar with the way to burn money for scale and flow. However, years of losses and no profit signal began to make the whole track die down, and then it gradually became a new consensus in the industry to stay away from the price war and increase revenue and reduce expenditure in order to make profits.

Map of fresh food retail channels source Orient Securities

Hou Yi frankly admitted last year that the root of the previous problem was to use Internet thinking to do retail. This is most obvious in the location of stores when HEMA initially expanded. "At that time, entering a city paid more attention to the full coverage of the distribution network and the number of people around a single store, but the common problem of these stores is that the business is not good, and the most important thing for physical stores is the location."

Relying on the methodology of Internet enclosure, the new retail trapped in the traffic cage has been unable to tilt too many resources to the transformation and upgrading of the industrial end and supply chain for a long time. In the view of many people in the industry, "HEMA is crossing the river by feeling the stone, and China's retail is crossing the river by feeling HEMA". Under the general environment of speed reduction and transformation of the track, HEMA, as a new retail benchmark, has to return to the foundation construction of traditional retail from the front-end format to the back-end supply chain, and embark on a new road of draining pits and crossing the river.

01

Feed yourself first

In an early interview, Hou Yi said, "the starting point for Alibaba to become a HEMA is to become an e-commerce with physical stores, and everything is operated around traffic." So from the very beginning, HEMA began to build stores with e-commerce thinking, positioning itself more in transit warehouses in site selection, paying no attention to the traffic of supermarkets, but only the number of people covered by their regional distribution.

In the early design of HEMA, 70% of store orders depended on online. At that time, HEMA's idea was very simple. Backed by the resource scheduling ability of Alibaba's digital middle office, it could increase the added value of retail goods and realize the increase of online user scale under the refined operation. Therefore, HEMA designed a set of hanging chain technology to help stores get through many links such as in store storage, sorting and distribution, so as to achieve the distribution efficiency of "30 minutes delivery".

It is unknown whether the performance efficiency is the moat of HEMA, but the racing mechanism in the industry has spawned a series of new e-commerce formats, including not only pre warehouse, community group purchase to grab the last kilometer, but also third-party platforms with urban distribution capacity such as meituan, which makes it difficult for the distribution timeliness of HEMA warehouse store integration to form a competitive barrier.

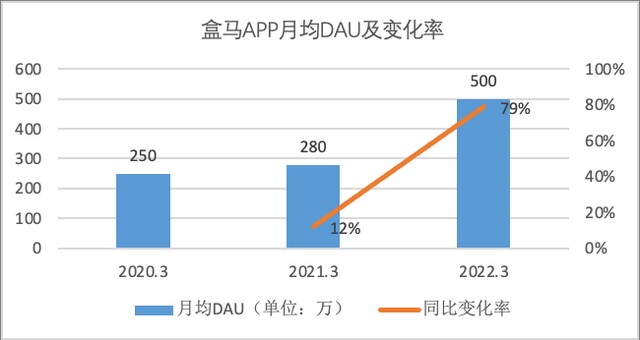

At the same time, although the dau of HEMA app did show an upward trend, and reached its peak when the epidemic broke out this year. However, the floor effect of online business increase cannot be translated into the actual profitability of the store, because corresponding to the performance efficiency, the online performance cost is high.

Monthly average dau and change rate of HEMA app

According to Chen Feng, head of a regional store in HEMA, the customer order of HEMA fresh food store is 120-150 yuan, of which the cost of distribution fee is 10-11 yuan. Moreover, when buying fresh food online, the unit price is not high, and this is the order of HEMA, which makes it difficult for the unit price to cover the performance cost, and HEMA's profit point is not online.

At the beginning of this year, Hou Yi proposed a new strategy "against" the past direction in his internal letter, upgrading the past "from online development to" multi industry online and offline collaborative development ". The specific operation is to increase the proportion of offline orders from 30% to 50%. In the new round of store expansion, the pace of closing old stores continues to accelerate. The idea of opening new stores has changed from full coverage of the city in the past to focusing on core business districts and new areas. At the same time, improving lighting, shelves, design, etc. is also a way to improve the experience of offline stores.

In the process of re examining the value of offline space, the business format of hemamen store is often new. For example, hotpot season, HEMA Night Restaurant and other store activities are representative works of HEMA's "supermarket + catering" model iteration. These activities are strongly bound with HEMA's commodity capabilities, such as crayfish and refined beer, which are the main products in the night restaurant, come from HEMA's own brand products with good sales performance and strong synergy with the upstream supply chain.

Some more pragmatic new business forms such as hemaole and X club are also helping to improve the profitability of stores. Olai store will sell the temporary goods in Xiansheng store, the products with slight bumps during transportation, and the daily fresh products that are not sold out on that day at a preferential price on the premise of ensuring the quality; With the floor area and SKU comparable to the traditional shopping malls, X Club gradually entered the middle and high-end consumer groups under the strategic layout of "going up" of HEMA.

In the internal letter, Hou Yi also mentioned that HEMA's goal this year is to improve its single store profitability to full profitability. It is likely that the main theme of business in the next few years will be to find ways to close the front line and expand profits, instead of relying on Alibaba, which is rich and powerful, and HEMA, which seeks its own way to make a living. This also means that HEMA is more and more similar to traditional retail in the form of the front desk.

02

Efficiency from the supply chain

There is an old saying in the retail industry that "momentum depends on flow, life and death supply chain", which may also be an iron rule for new retail. In recent years, HEMA, which has been learning from traditional retail, has made enough traffic in the first half of the new retail. In addition to paying attention to front-end stores, it has also begun to quietly work on the backstage supply chain layout.

Recently, two supply chain operation centers of HEMA in Wuhan and Chengdu have been put into full use as the backbone network of HEMA's own fresh food logistics system, which is the latest implementation of HEMA's construction of fresh food and food processing supply chain.

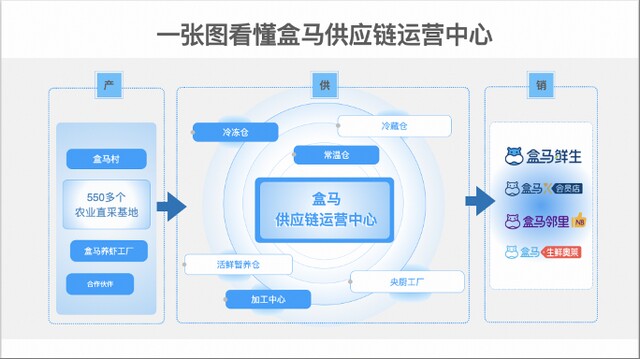

A few days ago, xinmou visited HEMA supply chain operation center in Chengdu and HEMA central kitchen factory "HEMA smart manufacturing" which has just been opened. Unlike conventional warehouses and logistics parks, HEMA's supply chain operation center adapts to HEMA's needs for fresh food, 3R and other different product lines, and has multi temperature cold chain warehouses, normal temperature warehouses, fresh food processing centers and central kitchen factories.

Production supply marketing system of HEMA

Return to commodity power and focus on private brands. HEMA's business strategy is to be efficient from the supply chain. "The biggest feature of HEMA supply chain operation center is the combination of fresh processing, central kitchen and other functions with commodity circulation functions, so that the efficiency of an integrated supply chain center will be much higher than that of distributed operations." Haojingbin, head of investment of HEMA supply chain center, said.

Efficiency is not only reflected in the operation of the whole chain, but also in different forms of efficiency promotion. According to the relevant person in charge, at present, in the production link, HEMA has signed more than 550 agricultural direct mining bases, including more than 100 "HEMA villages". In the supply chain, HEMA has 56 normal temperature and cold chain warehouses, 22 processing centers, and 10 live fresh temporary storage warehouses; In terms of sales, HEMA has opened more than 300 stores, covering 27 cities across the country.

In the HEMA supply chain operation center in Chengdu, the central kitchen factory "HEMA smart manufacturing" with "HEMA characteristics" made its debut. Fresh goods can be deeply processed into prefabricated vegetables or fresh food through intelligent central kitchen. Based on this, the marketing time of HEMA self-developed food can be shortened from half a month to three days.

At present, the private brands of HEMA system account for about 20%, while HEMA x member stores account for about 50%. Although there is still a certain gap with the proportion of more than 30% of European retail giants, expanding the proportion of private brands should be the product strategy that HEMA will adhere to for a long time. "HEMA workshop" is HEMA's own brand commodity with the largest sales volume, and its department has also been upgraded to 3R business department the year before last, which strategically enhances the importance of private brand construction.

Private brands can not only create differentiated goods, but also have higher gross profit. The operation environment can save energy and save intermediate costs such as multi-level distribution and advertising marketing. Once it is favored by consumers, retailers will take large purchase orders and ask suppliers to cooperate with it at the lowest price. Therefore, operating self owned goods is regarded as an important tool for retailers to regulate operating profits and deepen core competitiveness.

According to Chengdu supply chain operation center, the central kitchen factory has produced 22 private brand products in the first batch, which have been supplied to 4 regions and 5 cities. "We have preliminarily planned 160 products and strive to have them all listed before the end of this year.

Huang Haifei, head of HEMA national central kitchen, revealed that with the gradual release of central kitchen production capacity, he hopes to process and supply 70% of cooked food products, 70~80% of pasta products, 100% of semi-finished dishes and meat segmentation products in HEMA store in one to one and a half years.

To be efficient from the supply chain may be the way that new retail has to go. For fresh, frozen and refrigerated goods, the efficiency of the supply chain is the "life" insurance rate of goods. Secondly, the faster product renewal and the shorter time of new products can stimulate consumers to pursue novel shopping needs. And the digital supply chain logistics system can not only improve human efficiency, but also achieve the best benefits in the coordination of commodity circulation.

As Xiang Minghui, the head of supply chain business, said, "the consumption Internet changes the efficiency and cost of traffic distribution from quantity to quality, while the industrial Internet, on the contrary, the improvement of user experience is only tickets. Only by improving the efficiency of the entire industrial chain, can we really change from quantity to quality."

03

Flow connection supply chain

In the past, there was a common problem in the industry: those who can do traffic do not know much about the supply chain and can't get profits, and those who can do supply chain can't grasp the front-end iterative flow outlet. For the new retail with its own Internet gene, although they are familiar with the traffic playing method, they lack the precipitation of supply chain construction experience. At the same time, when the industry has generally not achieved full profitability, players often have no time to pay attention to the supply chain with heavy assets.

Therefore, we can see that in the first half of the new retail industry, there were few companies that really relied on the advantages of the supply chain to achieve industry leadership. Yonghui supermarket, which competes with HEMA on the same track and is famous for its supply chain management, is a typical player who focuses on the supply chain from the upstream. From the source to the processing center, then to the logistics center and even the urban warehouse, a series of large and small processes, such as origin inspection, quality inspection, price negotiation with small farms / cooperatives, logistics and packaging material supplier selection, as well as deep processing capacity, are mostly handled at one hand.

With its capital advantages, Yonghui has invested in a large number of supply chain related enterprises, such as Guolian aquatic products and Xingyuan agriculture and animal husbandry. It has jointly invested with Maotai as a messenger of friendship and incubated colorful fresh food. However, after a huge loss of nearly 4billion last year, Yonghui continued to lose 120million yuan in the first half of this year. The company had to plan to return from "new retail" to "traditional retail" this year. Behind the strong supply chain management, the flag of new retail fell.

Yonghui learned from the previous experience. Under the shackles of Internet thinking in the first half, the new retail industry can only crush itself by redoubling its deep supply chain. This makes people wonder whether the future new retail should invest too much in the supply chain, and what is the right way to do the supply chain?

"After capital comes in, it is not advisable to rely on subsidies to compete for the market." In an interview at the end of last year, Hou Yi revealed the idea of HEMA's deep cultivation of the supply chain. "Supply chain reengineering, process optimization, global procurement and differentiated competition are the real skills". Obviously, HEMA still chooses to fight the supply chain to the end, but it chooses a different supply chain approach from Yonghui, putting aside the source of the supply chain for the time being and turning to the intermediate R & D, production, logistics and distribution links.

Of course, fighting the supply chain is not to abandon the flow and ask for the flow from commodities. It is becoming a new breakthrough in the new retail competition. In the commodity structure of HEMA retail end, the importance of processed food is increasing. Hou Yi once said frankly that HEMA can't beat local retailers in terms of ordinary Minsheng brands, because they have a stronger local supply chain. HEMA's only way out is to supply goods from the national and even global supply chains.

The production entities of the processed food supply chain are more entrepreneurial and organized than the fresh food supply chain. Focusing on the needs of the young generation of urban people, we will launch new product research and development programs, and launch integrated demand to the upstream of the supply chain, which will eventually be reflected in the price advantage. Therefore, it can be seen that when the traffic acquisition no longer depends solely on the scale of money burning shops, but changes to demand traffic from commodities, the traffic entrance is increasingly forming a synergistic effect with the back-end supply chain, and it seems that it is natural and necessary to fight the supply chain.

However, although it is different from Yonghui's supply chain management ideas, some similar new details can still be seen in the business dynamics of HEMA, "after more than three years of tossing, the 'Hetian shrimp' raised at home has finally been listed." On July 5, Houyi released this message on the headline, which means that HEMA began to make self-supporting attempts at the source. If we can achieve "full profitability" in the future, as Hou Yi said, faced with higher profit margins and lower food safety risks brought by source control, HEMA may not be able to refuse to return to the path of Yonghui.

From increasing the research and development of private brand goods to now personally raising shrimp, an obvious signal is that HEMA is going deeper along the idea of supply chain management, but whether it can walk out of the right path still needs to be verified by the market.

Source / xinmou (id:xinmouls)

Author / LAN Binsheng