Research and judgment: is there another

The following article comes from ming'u sight, written by Da Benma

01

"Front wave" and "back wave" of mainstream tenants

For the logistics real estate whose products are high-standard warehouses, there are waves of emerging logistics industries behind each round of "great leap forward".

The huge rental demand brought by traditional international tripartite logistics enterprises, well-known manufacturing enterprises and large trading companies is why prosper has stepped into the crazy enclosure of China. At that time, the gray white "boxes" around the logistics agglomeration areas, port areas and highways often meant that this was the concentration area of internationally renowned enterprises.

However, the financial crisis once destroyed this prosperous scene, and the rental demand from these enterprises fell sharply. But at this time, with new "players" entering the game one after another, the supply of the high-level library has increased unabated.

When logistics real estate seemed to be on the brink of crisis, the rapid rise of e-commerce ignited a raging fire this winter. There must be merchants who have experienced the situation at that time. They remember how e-commerce companies led by jd.com packaged and leased several parks at one go.

Almost at the same time, the strong demand of e-commerce has also catalyzed the rapid development of express delivery business. Because of the business characteristics of such highway transportation enterprises, the rise of logistics real estate market in second tier, third tier and even fourth tier cities has been driven. Developers have found a blue ocean with high growth potential in addition to traditional large cities.

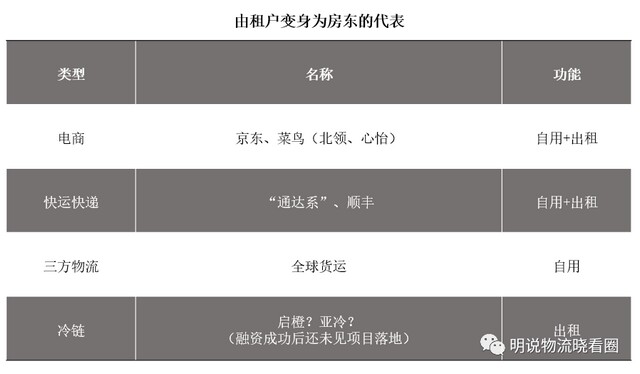

However, the incoming tide is fast, and the outgoing tide is also fast. These tenants, who have leveraged Tianliang capital and mastered sufficient technology, also began to learn from developers to build their own warehouses, firmly holding the initiative in their own hands. Many years later, some have changed and become the main competitors of previous landlords.

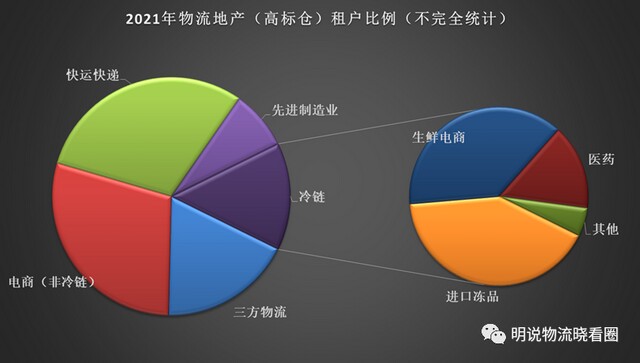

Although e-commerce and road transportation have not only promoted the spring tide, but also stirred the autumn tide, this cannot hinder the rise of another wave of emerging business forms. I really don't remember clearly whether the cold chain fired first or the fresh e-commerce fired first. Maybe the two are standing side by side. In short, they successfully took over the banner of the previous tenants, which not only filled the empty warehouse, but also led the developers to start a new round of investment.

However, when will this wave of tide roll over? Who will take over after the wave? It is still unknown.

02

Love will fade, not to mention the eternal tenant

Large enterprises have changed from leasing to self construction, and from tenants of developers to competing products. This is a strategic problem in economics that is very easy to understand. I mentioned the issue of integration strategy in previous issues (overview of the integration strategy of logistics enterprises), and this situation is a typical case of backward integration strategy.

For large e-commerce or road transportation enterprises, developers as suppliers are not enough to form a buyer's market in terms of quantity or the volume of warehouses provided. This leads to higher and unreliable supply side costs, and the price is always accompanied by instability.

At the same time, the huge return and profits of logistics real estate are also telling these large tenants that this is a very worthwhile area to enter.

In addition, the investment and construction pace of developers often cannot keep up with the speed of these users' own development, and the launch time of inferior products also strengthens the users' determination to obtain land by themselves.

Therefore, for developers, it will be normal for a tenant with healthy finance, stable business growth and in the air to take the land to build and use the warehouse by himself.

For now, it is the third-party logistics enterprises that focus on contract logistics that have been stable at the leasing end. However, for the dematerialization support that developers need to get, what tripartite logistics can contribute is far from enough.

03

Will the parameters of the standard library always be correct?

This is a sentence that may be condemned. However, in the actual scenario, we found that the structure of the existing high-standard warehouse could not meet the needs of users, and the situation began to emerge gradually. In fact, this is the inevitable result of the change in the type of mainstream tenants, the tightening of land supply and the rise in construction costs.

The standard setting period of the high-level warehouse is when the demand for third-party logistics and large-scale enterprise logistics is strong. What they need is to meet the functions of truck loading, in warehouse storage and so on. At this time, logistics real estate is still a "sweet pastry" in front of local governments, so whether in land supply or location selection, the green light is basically on. The controllable cost makes the developers feel comfortable in the design. As a result, sufficient floor height, wide venues, standard platforms and so on are integrated into a standardized structure.

However, as the land supply gradually began to be tight, government requirements, land prices, construction costs and other factors began to become the limiting conditions for continued investment and development. After that, logistics real estate, an industry that seeks a balance between logistics and real estate, can only increasingly begin to tilt towards real estate. The area of the house itself has become the most important key, while the operability, storage capacity and other conveniences required by warehousing and logistics have gradually become secondary considerations.

However, at this time, e-commerce and road transportation are at a stage of vigorous development. Therefore, in the core areas and some key logistics node areas, it often occurs that the warehouse conditions cannot meet the needs of customers. As a result, for a considerable period of time, some tenants had to require a certain degree of transformation of the warehouse itself before it could be used.

So are the parameters of the current standard library correct? Maybe it was before, but not now. It is certain that it must be changed in the future. But it can't be said that it is wrong, because logistics real estate is a real estate industry in the final analysis, which determines that its innate gene is still real estate, not logistics itself.

04

Big stupid horse's point of view

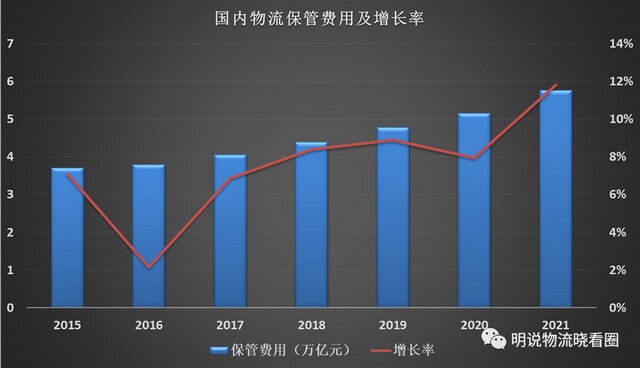

Logistics itself will not have any sudden explosion. In essence, it is the upgrading and change of a certain link of the chain according to the needs of the market. What we should grasp is the air outlet created by each change.

Whether it is e-commerce, express delivery, or fresh e-commerce, the rise and decline of each new logistics concept is closely related to consumers' pursuit of life. The refinement of living needs has created the rise of specific industries, and new industries have promoted the reform of the supply chain. As a guarantee of the smooth supply chain, logistics will enlarge and refine one of the links, thus forming a special subdivision.

As this field continues to receive attention, capital and professionals will enter to better improve it and bring full competition. As a link in logistics, warehouse will find new growth points at this time.

However, this does not mean that the logistics real estate, which is now relatively mature, does not need to be changed. On the contrary, in order to match the new fields that may appear in the future, the whole investment, financing, management and retreat model may need to "plan ahead". Some may be fine-tuning, some may be an operation.

Properties that do not respect or conform to changes will become sluggish and even abandoned.

This is why so many capital and developers investing in cold chain and cold storage have encountered problems. Some are encountering bottlenecks, and some dare not end up. It is because they are still looking at this business with the traditional dry warehouse idea, and are still building the upper layer on the basis of pure real estate.

Logistics itself will not have the so-called explosive point. Everything is just a change made to comply with the development of the times and the market. In fact, it is not appropriate to say change, because the natural logic of the flow of goods is unchanged, but one of the links will be optimized with the upgrading of demand.

Source / Mingshuo logistics Xiaokan circle (id:ming_sight)

Author / big stupid horse