Research Report: look at the great era from China trade logistics! What is the layout of China logistics group? Where will cross-border logistics go?

Source / Huachuang transportation and supply chain research (id:hczqjy)

Author / WuYifan, huangwenhe

preface:

1) At present, it is a window period of transformation and upgrading: traditional international freight forwarder → international cross-border comprehensive logistics service provider.

2) Cross border e-commerce logistics is the beneficiary of cross-border e-commerce dividends.

3) It is expected to open a new chapter when Huamao logistics is merged into China logistics group. China Logistics Group will focus on the needs of modern circulation system construction and strive to build a world-class comprehensive logistics group with complete industrial chain, strong comprehensive strength and global competitiveness.

At the same time, we reviewed our overseas experience and found that continuous M & A is a successful means to become an international cross-border comprehensive logistics service provider. Huamao is also practicing this path. After listing in 2012, it has successively acquired Dexiang logistics, ZHONGTE logistics, Hua'an Runtong, Huada international, Luoyang Zhongzhong, Jiacheng international, and successfully expanded customs supervised warehousing logistics, special logistics, international engineering logistics, postal air transport, cross-border e-commerce logistics and other fields on the basis of the original freight forwarding business, basically forming a competitive strength covering the whole industrial chain.

01

Huamao Logistics:

China's leading cross-border integrated logistics service provider,

China Logistics Group is the controlling shareholder

Founded in 1984, Huamao logistics is one of the earliest first-class international freight forwarding enterprises after China's reform and opening up. It was listed on the Shanghai Stock Exchange in may2012.

The company provides customers with point-to-point, port to port, door-to-door cross-border modern comprehensive third-party logistics services, covering transportation, warehousing, packaging, handling, loading and unloading, circulation, distribution, trunk transportation, port customs clearance services, document preparation, transaction settlement, etc. the service chain includes the whole process or part of the links. At the same time, it also provides consulting, analysis, diagnosis, design, optimization, control Information services and other comprehensive services.

Its main businesses include international air, sea and rail integrated logistics services, cross-border e-commerce logistics, international engineering integrated logistics, international warehousing logistics, other international integrated logistics services, and special logistics for large pieces.

1. The company is a leading third-party international integrated logistics service provider in China

In the latest "Top100 China freight forwarders" (2020) ranking released by China International Freight Forwarders Association in September, 2021, China trade logistics ranked 8th in comprehensive strength, 5th in international air transport business and 7th in international maritime transport business.

In the list of armstrong& associates, Inc. (a&a) in 2020, China trade logistics ranked 15th and 14th in the global freight forwarders, global air freight forwarders and 44th in the global third-party logistics respectively.

In 2021, the business volume of China International Shipping and air transportation will be 1035teu and 354000 tons respectively, which is within the scope of international leading transportation volume.

2. The company continues to expand its business territory

1) After listing in 2012, the company has continuously expanded its business types through endogenous and extended mergers and acquisitions.

Important extension M & A projects include Dexiang logistics, ZHONGTE logistics, Hua'an Runtong, Huada international, Luoyang Zhongzhong and Jiacheng international. Based on the original freight forwarding business, they have successfully expanded customs supervised warehousing logistics, special logistics, international engineering logistics, postal air transport, cross-border e-commerce logistics and other fields.

List of business expansion of the company:

In October, 2014, it acquired 65% of the shares of four companies including Shanghai Dexiang Logistics Co., Ltd;

In november2015, Xiamen branch and Hefei Branch obtained the international express business operation qualification;

In march2016, it acquired 100% equity of ZHONGTE Logistics Co., Ltd;

In May 2018, it established a strategic cooperation relationship with Schenker; In June, it signed a strategic cooperation agreement with "Beijing jingbangda Trade Co., Ltd." under JD group; In September, it signed a comprehensive cooperation agreement on transportation capacity with COSCO Shipping Container Transportation Co., Ltd;

In May, 2019, Henan Aviation Investment logistics (Luxembourg) Co., Ltd. was established in cooperation with Henan Civil Aviation Development Investment Co., Ltd., and in October, it increased the capital of Henan Aviation Investment Logistics Co., Ltd. by 118.5 million yuan through public delisting, and obtained 49% equity of Aviation Investment logistics; In August, it acquired 70% of the shares of Beijing Huaan Runtong International Logistics Co., Ltd. and Huada International Logistics Co., Ltd. respectively, and successfully entered the postal international air transport segment market;

In March, 2020, Huamao medical technology (Guangzhou) Co., Ltd. was completed and officially entered the field of medical logistics; In July, the company acquired 60% of the equity of Luoyang Zhongzhong Transportation Co., Ltd. and deeply cultivated the engineering logistics market; In November, the company formally prepared to establish a wholly-owned subsidiary in Mexico;

In July, 2021, the company purchased 70% of the equity of Hangzhou Jiacheng International Logistics Co., Ltd. for a consideration of RMB 500million to further layout the cross-border e-commerce full link transportation field;

In December, 2021, the company passed the certification system audit of Huawei international logistics services, marking that the comprehensive international logistics service capability of Huamao logistics has been fully recognized by Huawei again.

2) The business area of the company is expanding continuously.

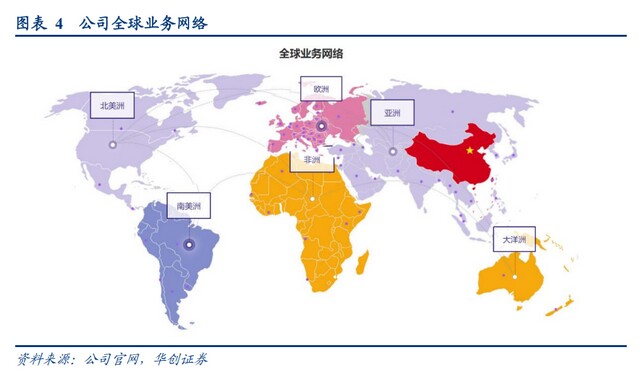

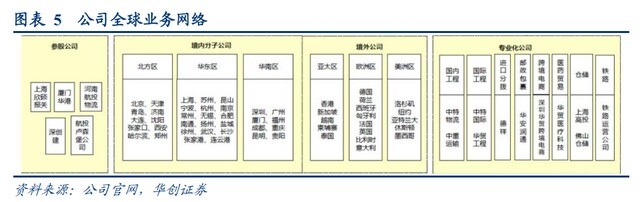

According to the company's official website, Huamao logistics has more than 90 branches, covering major ports in China, inland economically developed cities, Hong Kong, the United States, Singapore, Luxembourg, Germany, France, Italy, Spain, Hungary, the Netherlands, Belgium, the United Kingdom, Vietnam and other countries, including overseas networks in more than 160 countries and regions.

In recent years, the company has gradually expanded its business globalization process through the establishment of Henan Aviation Investment logistics (Luxembourg) Co., Ltd. and the establishment of wholly-owned subsidiaries in eight European countries.

3. Equity change process: CTS - > Chengtong - > China Logistics Group

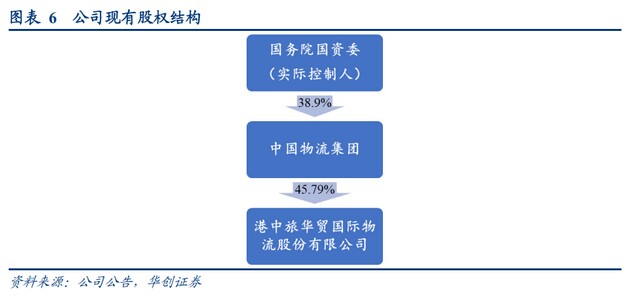

1) In 2017, the controlling shareholder of the company was changed from China Tourism Group to China Chengtong Group

In may2017, in order to improve the operation efficiency of state-owned capital and optimize the allocation of state-owned capital, the company's shareholder China tourism group transferred 41.85% of the company's shares to Chengtong Hong Kong free of charge; Three wholly-owned subsidiaries of China tourism group transferred 4.25% shares of China trade to Chengtong financial holding free of charge.

After the transfer, Chengtong Group, through its wholly-owned subsidiaries Chengtong Hong Kong and Chengtong financial holding, holds 45.81% of the shares of Huamao logistics, and Chengtong Group becomes the indirect controlling shareholder of the company.

2) In 2022, the controlling shareholder was changed from China Chengtong Group to China Logistics Group

At the end of 2021, the company's shareholders Chengtong Hong Kong and Chengtong financial holding were approved to transfer 45.79% of the equity of Huamao to China logistics group free of charge.

In April, 2022, the free equity transfer was completed, and the controlling shareholder of the company was changed to China logistics group.

3) China Logistics Group aims to build a comprehensive logistics group with global competitiveness

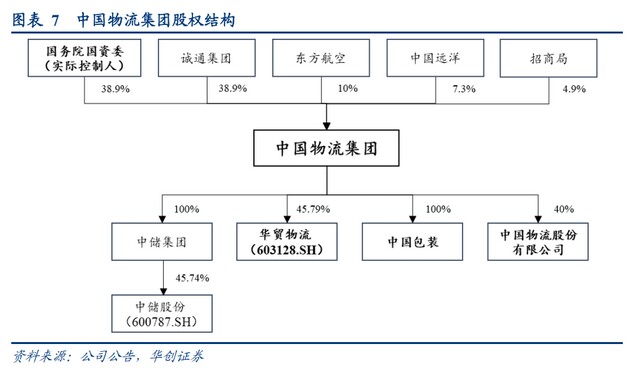

China logistics group was officially established on December 6, 2021. It is a diversified central enterprise under the direct supervision of the state owned assets supervision and Administration Commission of the State Council.

China Logistics Group is formed by the integration of the former China Railway Materials Group Co., Ltd., China materials storage and Transportation Group Co., Ltd. (China storage group), Hong Kong CTS China Trade International Logistics Co., Ltd. (China trade logistics), China Logistics Co., Ltd. and China Packaging Co., Ltd. in the logistics sector of China Chengtong Holding Group Co., Ltd.

Synchronous introduction of war investment to cover various resources of sea, land and air: China logistics group introduced China Eastern Airlines Group Co., Ltd., China Ocean Shipping Group Co., Ltd. and China Merchants Group Co., Ltd. as strategic investors, with shareholding ratios of 10%, 7.3% and 4.9% respectively, forming a close strategic synergy.

China Logistics Group will focus on the needs of modern circulation system construction, strive to build a world-class comprehensive logistics enterprise group with complete industrial chain, strong comprehensive strength and global competitiveness, position itself as a "comprehensive logistics service provider and global supply chain organizer", and give better play to the strategic supporting role of central enterprises in accelerating the construction of modern circulation system and building a new development pattern.

02

International air and sea integrated logistics as the cornerstone

Cross border e-commerce logistics becomes an important third pole

(1) Business Overview: the company seized the opportunity of cross-border logistics after the epidemic to achieve rapid growth

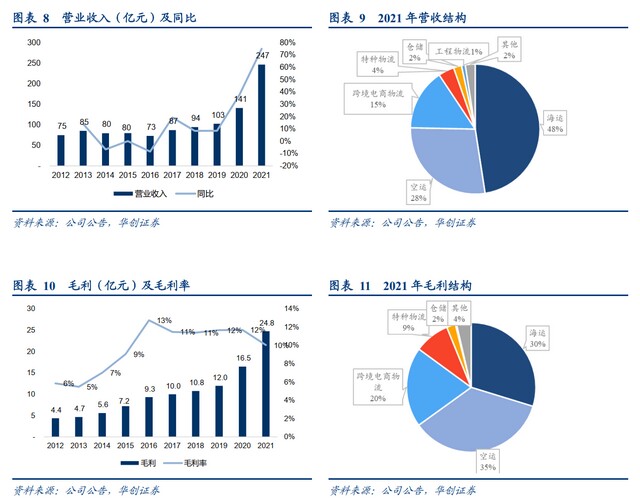

Revenue: from 2012 to 2016, the company's revenue basically remained at the level of about 7-8 billion yuan. In 2017, affected by the rising cost of transportation capacity procurement, the price increased, and the growth rate of revenue increased. After the outbreak in 2020, the shortage of global aviation and maritime transport capacity has brought development opportunities to service providers with strong comprehensive capabilities. The company has grasped this window and achieved revenue of RMB 14.1 billion and 24.7 billion from 2020 to 2021, with year-on-year growth of 37% and 75% respectively.

Gross profit: since the listing of the company, the gross profit has continued to grow. The gross profit of the company has increased by about 30% for two consecutive years from 2015 to 2016. From 2020 to 2021, the gross profit of the company was 1.65 billion yuan and 2.48 billion yuan respectively, with a year-on-year increase of 38% and 50% respectively.

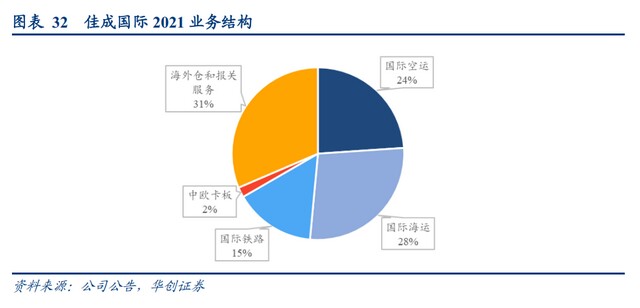

Revenue structure: in the company's revenue structure in 2021, shipping, air transportation and cross-border e-commerce logistics accounted for 48%, 28% and 15% respectively, reaching a total of 90%; Special logistics, warehousing and engineering logistics accounted for 4%, 2% and 1% respectively.

Gross profit structure: in 2021, the proportion of air transportation, sea transportation and cross-border e-commerce logistics will be 35%, 30% and 20% respectively, reaching 85% in total, and the corresponding gross profit margin will be 12.8%, 6.3% and 13.1% respectively. The gross profit of special logistics, warehousing and engineering logistics accounted for 9%, 2% and 0.3% respectively, and the corresponding gross profit margin was 22.3%, 11.2% and 3% respectively.

Since 2016, the company has started to reduce the supply chain trade business in an orderly manner, reduced the steel supply chain trade in 2016, and exited the electronic supply chain trade business in 20 years. Due to the low gross profit rate (less than 2%) under the business attribute, after optimizing the structure, the company's gross profit rate has been increased to more than 10% since 2016, and 11.7%, 11.7% and 10% respectively from 2019 to 2021, of which the gross profit rate of core products has remained relatively stable.

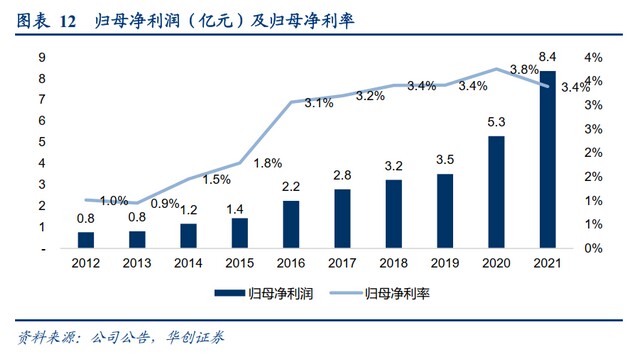

Net profit attributable to parent company:

The company's net profit attributable to the parent company was RMB 80million in 2012, exceeded RMB 100million in 2014, exceeded RMB 200million in 2016, and exceeded RMB 300million in 2018. In 2014-18, the company maintained a compound growth rate of about 30%, and the net interest rate increased steadily. In 2012-16, the company's net interest rate increased from 1% to 3.1%. The net interest rate in 2016 rose to 3.1% from the previous 1.8%, mainly due to the further enhancement of business platform construction and collaboration level, and the further improvement of customer aggregation ability and market share; The implementation of centralized procurement for transportation capacity and freight rate further reduces costs; As well as the achievements of M & a strategy, mainly the contribution of ZHONGTE logistics and the synergy played by Dexiang in that year.

From 2020 to 2021, the net profit attributable to the parent company was RMB 530million and RMB 840million respectively, with a year-on-year increase of 51% and 58% respectively, and the net profit attributable to the parent company was 3.8% and 3.4% respectively.

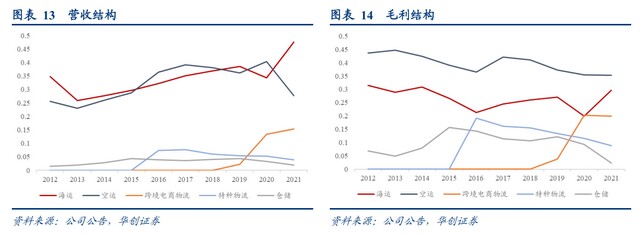

Attachment: changes in the proportion of revenue and gross profit of each section

From the perspective of revenue structure: the proportion of ocean shipping business increased significantly in 21 years

Shipping business: 30-40% in 2016-2020 and 48% in 2021;

Air transport business: 35-40% in 2016-2020 and 28% in 2021;

Special logistics business: listed after the acquisition of ZHONGTE logistics in 2016, the revenue from 2016 to 2021 accounted for 4-8%;

Cross border e-commerce logistics: since 2019, the proportion of revenue has continued to increase, from 2% in 19 to 15% in 2021; Warehousing and logistics: accounting for 2-4%.

From the perspective of gross profit structure: the gross profit of air transport business accounts for the highest proportion and cross-border logistics improves the fastest

The gross profit of sea transportation and air transportation is relatively stable, ranging from 20-32% and 35%-45% from 2012 to 2021 respectively, and the gross profit of air transportation is the highest;

The gross profit of special logistics accounts for an average of about 11% in recent three years;

The proportion of cross-border e-commerce logistics gross profit increased from 4% in 2019 to 20% in 2021.

Below we further analyze the main businesses of the company.

(2) International air and sea integrated logistics: core cornerstone business and an important source of profit

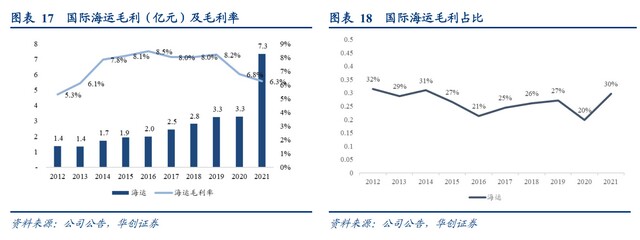

In 2021, the revenues of the company's international shipping and international air transportation businesses were 11.73 billion yuan and 6.85 billion yuan respectively, accounting for 47.6% and 27.8% of the overall revenue respectively, accounting for about 75% in total; The gross profit is 730million yuan and 870million yuan respectively, accounting for 29.8% and 35.4% respectively, accounting for about 65% in total. It is an important source of profit for the company.

1. International Shipping: the results of product transformation have initially appeared, and the gross profit per container has increased significantly in 21 years

Operating revenue: from 2012 to 2019, the company's international shipping operating revenue increased from 2.6 billion to 4billion, with a CAGR of 6%. From 2020 to 2021, the revenue was respectively 4.8 billion yuan and 11.7 billion yuan, of which the year-on-year growth in 2021 was 143%. Through the continuous construction of marine products in the past few years, the company can better respond to the needs of customers and the market through product diversification, which makes the company make a great breakthrough through comprehensive logistics services under the extremely tight market capacity.

In terms of the proportion of revenue, the proportion of revenue of shipping business will remain between 30-40% from 2012 to 2020, and will rapidly increase to 48% in 2021.

Gross profit: the international shipping gross profit of the company increased from 140million yuan to 330million yuan from 2012 to 2019, with a CAGR of 13%. The gross profit from 2020 to 2021 was 330million yuan and 730million yuan respectively, of which the year-on-year growth in 2021 was 124%.

In terms of the proportion of gross profit, the marine business will be 27%, 20% and 30% respectively from 2019 to 2021

Analysis from volume price dimension:

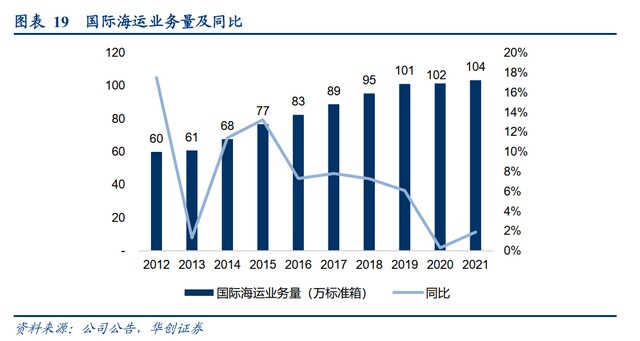

Business volume: it has been growing steadily in recent ten years, with a CAGR of 6% from 2012 to 2021. From 2020 to 2021, it will achieve 1.016 million TEUs and 1.035 million TEUs respectively, with a year-on-year increase of 0.3% and 1.9% respectively.

International shipping unit price:

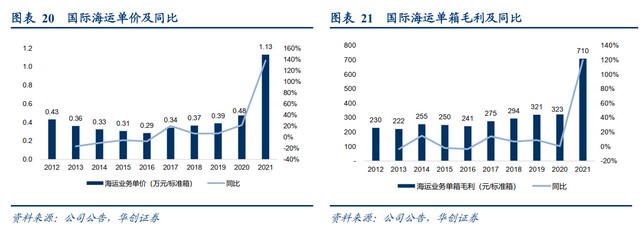

From 2019 to 2021, the unit price of international shipping business was 39, 48 and 11300 yuan / TEU respectively, with a year-on-year increase of 6.8%, 21.8% and 138.2% respectively;

Gross margin of international sea waybill:

In 2012-16, the company's gross profit per container fluctuated in the range of 220-250 yuan. From 17-19 years, it kept rising to more than 300 yuan. In 2020-21, the gross profit per container of international shipping business was 322.8 yuan and 709.9 yuan / TEU respectively, an increase of 0.6% and 120% year-on-year respectively.

In 2021, the gross profit per container of international shipping business increased significantly, mainly because: under the market background of very tight transport capacity resources, the company gradually abandoned the logistics products and services in the link of booking manifests, which occupy a large amount of resources, and transformed to the full process integrated logistics services, so as to realize the rapid improvement of shipping performance.

2. International air transport: gross profit accounts for the highest proportion. Under the epidemic situation, we will continue to develop high-quality direct passengers and strengthen air transport service capacity

The company's international air logistics services include industrial general goods, cross-border e-commerce goods, international express goods and goods through the universal postal channel.

Operating revenue: the CAGR of the company's international air transport operating revenue from 2012 to 2019 was 10%, and the revenue from 2020 to 2021 was RMB 5.7 billion and 6.85 billion respectively, with a year-on-year increase of 53% and 20% respectively.

In 2020, after the outbreak of the epidemic, international airlines' passenger planes were grounded in a wide range, which made the overall transport capacity of the air transport market highly strained. The company continued to obtain direct major customer business by increasing service links, extending the service chain and improving service quality, and successfully developed Alibaba, jd.com, Huawei, Xiaomi technology, Hikvision, ZTE, Dahua Technology, Dajiang innovation, SAIC, CRRC, China pharmaceutical, China exemption group Xiamen Swire and other high-quality direct customers.

In terms of revenue structure, the proportion of air operation revenue remained above 35% from 2016 to 2020. In 2021, due to the rapid growth of sea transportation business, the proportion of air transportation revenue declined.

Gross profit: from 2012 to 2019, the company's gross profit of international air transportation increased from 190million to 450million, with CAGR of 13%. From 2020 to 2021, the gross profit was 590million and 870million yuan respectively, with a year-on-year increase of 31% and 49% respectively. The gross profit margin in 20-21 years is 10.3% and 12.8% respectively.

In terms of gross profit structure, the gross profit ratio of air transportation business is stable as a whole, maintaining between 35% and 45% in recent ten years, which is the business segment that contributes the most to the gross profit of the company.

Analysis from quantity and price dimensions:

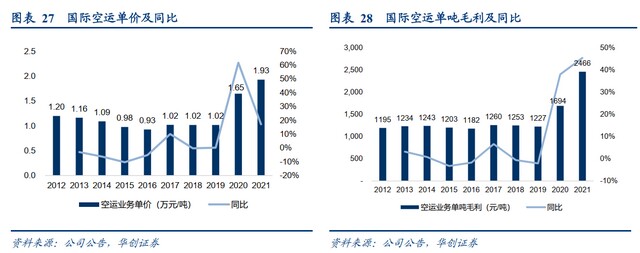

In terms of international air transport business volume, it has grown steadily in the past decade, maintaining a compound growth rate of about 12% from 2012 to 2019, achieving 345000 tons and 354000 tons respectively from 2020 to 2021, with a year-on-year growth rate of -5.2% and 2.6% respectively. Under the 20-year epidemic situation, restricted by the shortage of international transport capacity, the business volume declined, and gradually recovered in 21 years.

From the international air freight unit price:

From 2019 to 2021, the unit price of international air transport business was 10200 yuan / ton, 16500 yuan / ton and 19300 yuan / ton, respectively, 0.2%, 61.8% and 17.1% year-on-year; Under the 20-year epidemic situation, the global air cargo resources were tight, and the unit price of the company increased accordingly.

Gross profit of international air transport unit:

From 2012 to 19, the gross profit per ton fluctuated in the range of 1200-1250 yuan. From 2020 to 21, it rapidly increased to 1694 yuan and 2466 yuan / ton, 38.1% and 45.6% respectively year-on-year, with high growth for two consecutive years. After the outbreak, the company seized the opportunity and continued to develop direct key customers, bringing about an increase in unit gross profit.

From 2021 to 22, the company further strengthened the construction of air transportation system, and the main achievements include:

1) Continue to build overseas self operated transport capacity products. On the basis of establishing local and domestic marketing channels in Europe, the European team launched products such as the "London Hangzhou" route of passenger to cargo import full chain services;

2) Promote the normalization of the operation of fixed aviation products. The normalization of the operation of Yancheng Japan South Korea line, Nanjing Taipei, Xi'an Moscow, AMS round-trip YVR and other fixed aviation products has effectively promoted the transportation of live animals such as Beijing Almaty vaccines, breeding pigs and alpacas from specific enterprises;

3) In 2022, it signed a strategic cooperation agreement with China Eastern Airlines logistics.

a) Jointly provide global logistics solutions for large manufacturing customers. The ability of China trade logistics to integrate logistics resources for manufacturing customers, combined with the full cargo aircraft and passenger aircraft belly compartment transportation capacity of China Eastern Airlines logistics, has formed specialized and full chain logistics solution products, helping China's manufacturing industry to go global;

b) Jointly carry out overseas return source development. Make use of the overseas networks of both sides to jointly carry out cooperation in the development of overseas return cargo sources, improve the return carrying rate of international routes and optimize the operation efficiency;

c) Integrate the resources of both parties and open up the logistics supply chain. Make use of the resources of both sides in trunk lines, outlets, customs affairs, multimodal transport and other resources, open up the logistics supply chain, provide customized landing solutions for customers, assist customers to achieve the landing of "the last mile", and attract and lock high-quality customers in the industry with professional and integrated services.

4) In 2022, an international cargo airline was jointly established. In March, Huamao logistics signed an intention agreement with Jiacheng international and Guangzhou zhidu investment to set up an airline. Huamao contributed 275million yuan in cash, accounting for 55% of the registered capital of the joint venture. Meet the logistics needs of customers and the market by operating aviation logistics warehousing, transportation, international freight forwarding and other businesses.

(3) Cross border e-commerce logistics: it has become the third largest business pillar and important growth pole of the company

The cross-border e-commerce logistics business mainly includes: international postal airmail letters (postal packets), special line logistics, cross-border e-commerce commodity air sea rail trunk transportation, as well as the corresponding supporting services such as ground collection, security inspection, distribution, packaging, customs clearance, overseas warehouse and terminal delivery. At the same time, the company operates the cross-border e-commerce import and export customs supervision area, and can provide customs clearance, commodity distribution, truck customs clearance and inspection and other services.

1. The company promotes the expansion of cross-border e-commerce business through mergers and acquisitions

1) After acquiring Hua'an Runtong and Huada international in 2019, the company entered the international air transport service market of postal service and started business in the field of cross-border e-commerce logistics.

2) After the acquisition of Hangzhou Jiacheng in 2021, the business capacity will be further improved:

In July, 2021, the company acquired 70% of the shares of Hangzhou Jiacheng International Logistics Co., Ltd., with a transaction consideration of RMB 505million.

Significance of cooperation between the two sides: Jiacheng logistics has business experience and layout in the field of cross-border e-commerce logistics, especially its strong ability in front-end collection, customs affairs and overseas terminal services.

After the acquisition of Jiacheng,

First, it can build a full product line, full service chain and full digital capability in the field of cross-border e-commerce logistics.

Second, combined with the traditional trade of general goods, postal parcels and the FBA dedicated e-commerce goods of Jiacheng logistics, we will further build and enrich the trunk products of China trade logistics.

Thirdly, based on the cooperative relationship between China trade logistics and China Post, it grafts the overseas final journey service of Jiacheng logistics to open up the global supply chain system for China Post's non postal business.

3) In March, 2021, it acquired 33.5% of the equity of Shenzhen shenchuang supply chain Co., Ltd., obtained the advantageous resources in cross-border logistics and customs clearance, and formed a closed-loop service system of "going out, coming in and returning" for e-commerce goods.

Through integration, the company's strategic layout in the field of cross-border e-commerce logistics has begun to take shape. The business service objects include postal service, cross-border e-commerce platforms and seller customers. The service capabilities include front-end goods solicitation, transshipment and distribution, export customs declaration, trunk transportation, import customs clearance, overseas warehouse distribution, and the ability to integrate the final delivery. The service products include postal parcels, FBA special lines, international express, and personal express.

2. The gross profit has reached 20%, which has rapidly grown into the third pillar and important growth pole of the company

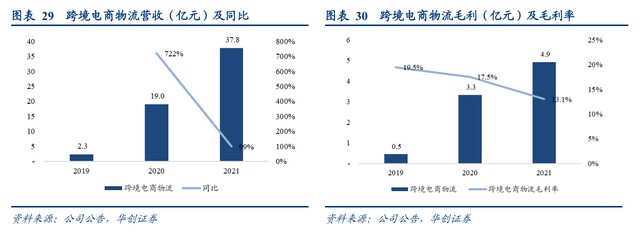

Operating revenue: from 2019 to 2021, the revenue of cross-border e-commerce logistics sector reached RMB 230 million, RMB 1.9 billion and RMB 3.78 billion respectively, with a year-on-year increase of 722% and 99% respectively from 2020 to 2021.

From 2019 to 2021, the revenue of cross-border e-commerce logistics business accounted for 2%, 13% and 15% respectively.

Gross profit: from 2019 to 2021, the gross profit of cross-border e-commerce logistics business is RMB 50 million, RMB 330 million and RMB 490million respectively, and the gross profit margin is 19.5%, 17.5% and 13.1% respectively. From 2020 to 2021, the gross profit increased by 640% and 48% respectively year-on-year.

From 2019 to 2021, the gross profit of cross-border e-commerce logistics business accounted for 4%, 20.2% and 20% respectively.

The financial performance of Jiacheng international in recent three years: the operating revenues from 2019 to 2020 are 1.22 billion and 1.2 billion respectively. We expect to double the growth to reach the level of 2billion + in 2021. (the revenue of Jiacheng from August to December in 2021 is about 1.057 billion).

From 2019 to 2021, the net profit was RMB 24 million, RMB 39 million and RMB 48 million respectively, with a year-on-year increase of 63% and 23% in 2020 and 2021 respectively.

3. Operational aspects

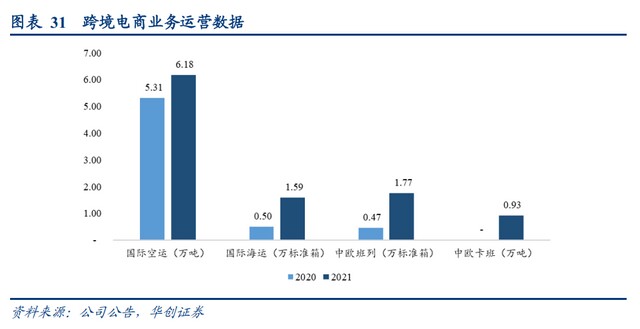

In 2021, the company's cross-border e-commerce logistics business achieved 61800 tons of international air transport, a year-on-year increase of 16%; 15900 TEUs were transported by international shipping, a year-on-year increase of 219%; China Europe Express Trains totaled 17700 TEUs, a year-on-year increase of 276%; China Europe Kaban is 9300 tons.

From the operation data of Jiacheng International:

In 2021, Jiacheng international achieved 105300 tons of cross-border e-commerce logistics packages, an increase of 118% year-on-year. Including 25000 tons of international air transport, accounting for 24%; 29000 tons of international shipping, accounting for 28%; 16000 tons of international railways, accounting for 15%; China EU Kaban is 2000 tons, accounting for 2%; Overseas warehouse and customs declaration services were 33000 tons, accounting for 31%. Jiacheng has contributed to the development of the company's cross-border business.

4. From 2021 to 22, the company continued to promote the development of cross-border e-commerce logistics, and the main achievements include:

1) Strengthen product construction, open self operated scheduled flights to Taipei and truck flights to Liege, Belgium; The US overseas warehouse opened the t86 customs clearance mode, signed logistics cooperation agreements with e-commerce platforms and independent stations such as dunhuang.com, tiktok, shopfy, shopline, tmall global and jd.com, signed airport ground service and agency agreements with cainiao.com, and carried out comprehensive cooperation with China post parcel to Russia.

In terms of direct customer service, the company has successfully developed high-quality customers such as kevos, Zebao, Lanting and ByteDance, and has reached comprehensive strategic cooperation with cross-border e-commerce platforms such as dunhuang.com and independent stations such as sheen. It has achieved marketing breakthroughs for high-quality customers such as Mindray medical, Tianma microelectronics, Jiuan medical, Hisense electronics, Coolpad, glory, rookie logistics, BYD, Midea, and OPP lighting.

On June 14, 2022, the company issued an announcement and signed a special cross-border e-commerce contract with lazada:

The contract amount is about RMB 160million, and the flight frequency will be increased from three times a week to three times a day from June 11, 2022. After the schedule of flight execution date is adjusted, the total number of shifts is 294.

The company successfully opened the Kunming Kuala Lumpur scheduled international all cargo aircraft route, which is the first new scheduled international all cargo aircraft route of Kunming airport in 2022. It is also a key link in the full chain service developed by the company for lazada, which is conducive to meeting the logistics needs of the company's customers with structural changes.

The cooperation between the company and lazada can achieve the basic cargo volume of chartered flights, provide more efficient services, and have a large premium space for the remaining shipping space. In the future, the company is expected to replicate the lazada model, realize more cross-border e-commerce logistics charter routes, and enhance global service competitiveness.

2) Create products with core competitiveness. 9710 e-commerce customs clearance is opened in Yancheng, international express customs clearance is opened in Nanjing, 9610 customs clearance service, 9710, 9810 declaration service and 1210 import service are opened in Dalian, Chongqing and Nanjing, and 9610 and express declaration export service are opened in the company.

3) Overseas warehouses made new progress. In terms of first trip transportation, the layout integrates high-quality overseas warehouses, and FBA's marine warehousing business has achieved more than 100% growth.

4) It has reached cooperation with Shenzhen Nanyou group to obtain 75000 square meters of bonded warehouse resources of Shenzhen cross-border e-commerce import and export base.

5) The cross-border e-commerce logistics business of Hua'an Runtong, Shenzhen Chuang Chuang and Jiacheng international cooperation includes sharing and cooperation in front-end collection, warehouse operation, customs declaration, trunk line transportation, and final delivery, so as to realize the sharing of customer resources and service platform resources, and jointly build a full chain and integrated cross-border e-commerce logistics system.

(4) Other businesses: serving China's industrial manufacturing upgrading and going to sea

Other businesses of the company mainly include special logistics, warehousing and engineering logistics. In 2021, the operating revenue was RMB 980million, RMB 490million and RMB 240million respectively, accounting for 4%, 2% and 1% of the revenue respectively; The gross profit is RMB 220million, RMB 60million and RMB 10million respectively, and the gross profit accounts for 9%, 2% and 0.3% respectively.

1. Special logistics for extra large parts

The special logistics business is mainly to provide customers with comprehensive logistics services such as power engineering logistics, project large cargo transportation, dangerous goods transportation, storage and distribution, including railway large cargo special train transportation, power plant fuel railway transportation, road transportation of various large equipment, waterway transportation, wind power equipment transportation, power plant storage service projects, railway asphalt, oil transportation, railway and highway transportation of uranium and nuclear waste materials.

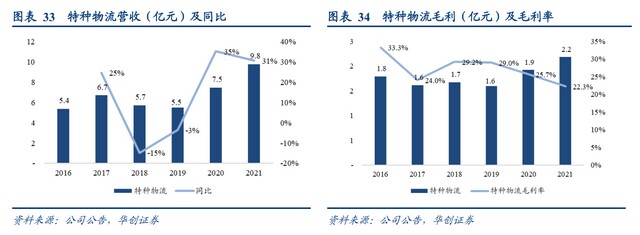

Operating revenue: the CAGR of the company's special logistics operating revenue from 2016 to 2021 was 13%, and the revenue from 2019 to 2021 was RMB 550million, RMB 750million and RMB 980million respectively, with a year-on-year increase of -3%, 35% and 31% respectively. The rapid growth in the past two years is mainly due to:

1) ZHONGTE logistics has increased its efforts to develop customers outside the power market;

2) Luoyang Zhongzhong offshore wind power transportation business made breakthrough progress.

Gross profit: the CAGR of the company's special logistics from 2016 to 2021 was 4%, and the gross profit from 2019 to 2021 was RMB 160million, RMB 190million and RMB 220million respectively, with a year-on-year increase of -4%, 20% and 14% respectively. From 2019 to 2021, the gross profit margin is 29%, 25.7% and 22.3% respectively. The gross profit margin is relatively stable as a whole.

Net profit: according to the segment financial report of the company, the net profit of special logistics from 2020 to 2021 is 105million and 100million respectively, and the net interest rate is 14% and 10.2% respectively.

In 2016, the company acquired ZHONGTE logistics and opened the special logistics business segment of the company.

In 2020, the company acquired 60% of the equity of Luoyang Zhongzhong transportation. Luoyang Zhongzhong mainly focused on the machinery manufacturing field, and made a breakthrough in the offshore wind power transportation business in 2021.

1) ZHONGTE Logistics

ZHONGTE logistics is specialized in domestic and international engineering logistics services. It mainly undertakes seven business segments, including engineering logistics, international logistics, dangerous goods logistics, project warehousing and distribution, railway special line operation management, bulk goods logistics, project consulting and planning.

a) The company's business focuses on the non standardized logistics and transportation services for over limit and overweight, mainly transporting UHV power equipment:

The company adopts multi-modal highway, railway and waterway transportation, and undertakes the transportation task of thousands of large transformers in the key projects of national UHV power grid construction, such as the Three Gorges, Jingmen, Fulong, Pu'er, Chongqing Hubei, central Tibet, Changji, etc;

Successfully completed the third-party logistics management of the thermal power plant equipment of more than 30 300MW, 600MW and 1000MW unit projects, including expediting, transportation, storage, installation services, data transfer, etc;

It has undertaken the operation and management of special railway lines for more than 10 power plants;

The company's joint venture China Guanghe uranium logistics (Beijing) Co., Ltd. is the only logistics and transportation platform for nuclear fuel of China Guanghe group. It has all the qualifications for road transportation of category 7 dangerous goods, and is also the first and only transportation unit in China with the qualification for railway commercial transportation of category 7 dangerous goods. Since 2005, the company has organized more than 50 times of transportation of radioactive materials such as nuclear waste, nuclear waste, natural uranium and petrochemical dangerous goods such as asphalt.

b) The company develops special transportation equipment by itself: Taking the opportunity of project construction, the company develops special transportation equipment. It has successively developed 20 special railway vehicles, 30 sets of highway bridge vehicles and concave bottom vehicles with domestic vehicle manufacturers, and has obtained 17 utility model technical patents for various machines and tools.

The special railway vehicle for medium and special logistics transportation of UHV power equipment is self-designed and has complete intellectual property rights. The maximum single vehicle transportation capacity can reach 1800 tons. It provides logistics services for the national UHV power grid, 1000MW generator units and large petrochemical projects, and provides logistics services for the power, petrochemical, machinery, steel, nuclear industry and other industries. The core competitive advantage is obvious, and the domestic market share continues to lead.

c) The company has established a complete logistics service network: the company has established an engineering logistics base in Hunan, an international logistics base in Shanghai, and an energy and chemical logistics base in Guangxi to provide supporting logistics services for electric power, petrochemical, machinery, metallurgy, nuclear power engineering and other industries, and has begun to participate in the construction of wind power, photovoltaic, offshore wind power and other new energy construction projects.

d) Extension business development of ZHONGTE Logistics:

In May, 2021, the company invested 45million yuan to set up Huamao Railway Operation Management Co., Ltd. in Chongqing western logistics park with its partners to engage in railway freight forwarding business mainly focusing on international container railway agency business and container yard service (designated yard of southbound channel), and vigorously promote domestic railway bulk material transportation, railway special line operation and maintenance and other businesses. Through the centralized integration of multi-party resources and professional teams, Create a third level of development besides air and sea transportation.

In August, 2021, the company invested 21.6 million yuan to integrate hengzhan Far East's end journey service capabilities in East Africa and South Asia through the establishment of a joint venture, and to coordinate the expansion of engineering logistics business at home and abroad. Further expand the land transportation, customs clearance, warehousing and other resource advantages in South Asia, Africa and other regions, assist the company in extending its engineering logistics business to the overseas end, and enhance its tail end service capacity.

The joint venture between China Teflon and hengzhan Far East will load 136 air-cooled self-contained containers on bulk cargo ships and send them to Baltimore port in the United States. The first batch of non-standard containers for Huawei data center equipment will be loaded on bulk cargo ships and sent to Chittagong, Bangladesh, which can carry the largest offshore wind power single pile in Asia.

e) Financial situation:

Due to the acquisition, ZHONGTE logistics promised to deduct the net profit not attributable to the parent company from 2015 to 2017, and has completed the relevant performance commitments:

In 2015, the net profit not attributable to the parent company was RMB 98million, and the performance commitment completion rate was 108.57%;

In 2016, the net profit not attributable to the parent company was RMB 118million, and the performance commitment completion rate was 117.79%;

In 2017, the company realized a net profit of RMB 102million, which was not attributable to the parent company, and the performance commitment completion rate was 120.15%.

In 2021, ZHONGTE logistics achieved an audited net profit of 102million yuan.

2) Luoyang Zhongzhong

In 2020, it purchased 60% of the equity of Luoyang Zhongzhong Transportation Co., Ltd. for a transaction consideration of 69.21 million yuan. Luoyang Zhongzhong mainly focused on the machinery manufacturing field and made a breakthrough in the offshore wind power transportation business in 2021.

From 2020 to 2021, the audited net profits of Luoyang Zhongzhong were 21.51 million yuan and 33.76 million yuan respectively, with a year-on-year increase of 57% in 2021.

2. International warehousing logistics

The company's international warehousing and logistics is operated by its subordinate Dexiang group, which provides the import container distribution service with special qualification. It has the fifth supervision zone (customs supervision warehouse) of Shanghai Customs of the people's Republic of China approved by relevant departments, covering an area of 39000 square meters, and has the functions of import distribution, customs declaration, inspection, warehousing, bonded, inland container transportation It is a comprehensive professional logistics service capability integrating customs supervision on goods transit and transportation.

The company operates international warehousing and logistics in China, Hong Kong, Southeast Asia, Africa, the Americas and other major port cities, providing basic service guarantee for international air, sea and rail freight forwarding business and cross-border e-commerce logistics business.

In 2014, Huamao logistics acquired Dexiang group at a consideration of 207million yuan.

Dexiang logistics is one of the six logistics enterprises with import distribution qualification in Shanghai. In the franchise field of import warehousing distribution, Dexiang logistics has a market share of more than 35% at the time of acquisition.

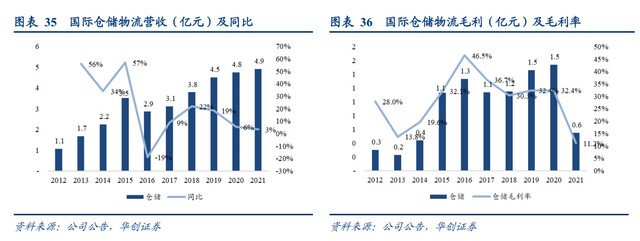

Operating revenue: the company's international warehousing and logistics operating revenue CAGR from 2012 to 2021 was 18%, and the revenue from 2019 to 2021 was RMB 450million, RMB 480million and RMB 490million respectively, with a year-on-year increase of 19%, 6% and 3% respectively.

Gross profit: the company's international warehousing and logistics gross profit CAGR from 2012 to 2020 was 23%, a year-on-year decrease of 64% in 2021, and the gross profit from 2019 to 2021 was 150million yuan, 150million yuan and 60million yuan respectively, a year-on-year increase of 27%, 5% and -64% respectively. The gross profit margin from 2019 to 2021 is 32.4%, 32.4% and 11.2% respectively.

3. International Engineering integrated logistics

International engineering logistics means to create an integrated logistics solution for engineering materials for customers through further expansion and extension based on the international air, sea and rail freight forwarder according to their different needs.

The customers of the company's international engineering logistics services are mainly Chinese enterprises going out in the petrochemical, electric power, metallurgy, mining, nuclear power construction, infrastructure, rail vehicles and other industries in the countries and regions along the "the Belt and Road". The service category is mainly general cargo, and it is also engaged in bulk cargo chartering transportation.

The business scope mainly includes project logistics consulting, ocean chartering and space booking, air and railway transportation, domestic and foreign land transportation, international multimodal transport, port combing, customs declaration and commodity inspection, warehousing and transit, cargo insurance agency, on-site warehousing and distribution, coordination and installation, spare parts and materials transfer, etc., so as to realize the full integration of international engineering logistics services.

Based on the professional team of transportation and material custody, the company has implemented in the construction of 100000 housing projects in Angola, Vietnam Yongxin Power Plant Phase I project, Vietnam coastal power plant project and other projects. At present, the company has set up branches or logistics centers and other offices in Angola, Vietnam, Cambodia, Malaysia, Brazil and other countries, and has built a strong global engineering logistics service network.

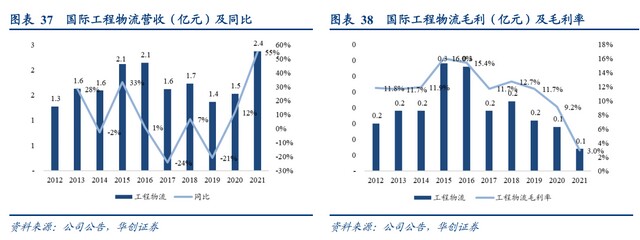

Operating revenue: the CAGR of the company's international engineering logistics operating revenue from 2012 to 2021 was 7%, and the revenue from 2019 to 2021 was RMB 140million, RMB 150million and RMB 240million respectively, with a year-on-year increase of -21%, 12% and 55% respectively.

Gross profit: the company's gross profit of international engineering logistics from 2019 to 2021 was RMB 20million, RMB 100million and RMB 100million respectively, with a year-on-year growth of -27%, -13% and -50% respectively. The gross profit margin from 2019 to 2021 is 11.7%, 9.2% and 3% respectively.

03

From overseas experience,

Continue to acquire and become an international cross-border comprehensive logistics service provider

(1) International leading freight forwarders continue to grow through mergers and acquisitions

We combed the M & a development history of Kuehne & Nagel, DSV, one of the top five large and medium-sized enterprises in the world, and Kerry Logistics, one of the representative enterprises of Asian freight forwarding, and found that the world's leading freight forwarding companies gradually expanded their business areas horizontally and vertically through continuous M & a, becoming a comprehensive cross-border logistics service company covering all fields.

1. Kuehne & Nagel

Headquartered in Switzerland, founded in 1980, Dexun group is the world's largest non wheel operating common carrier, with business covering Europe, America, Asia, Africa and other regions. It has 1300 sub stations in more than 106 countries around the world, providing high-value comprehensive logistics services to the world.

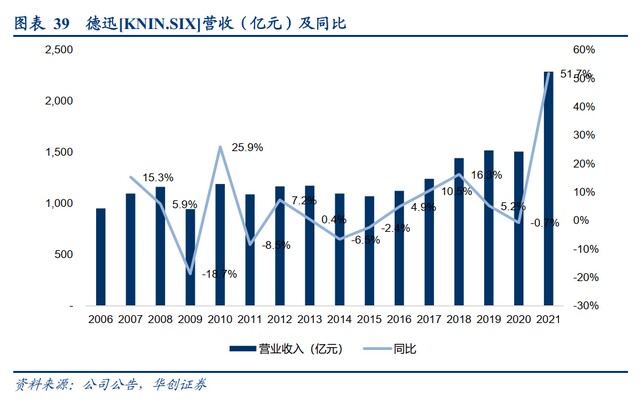

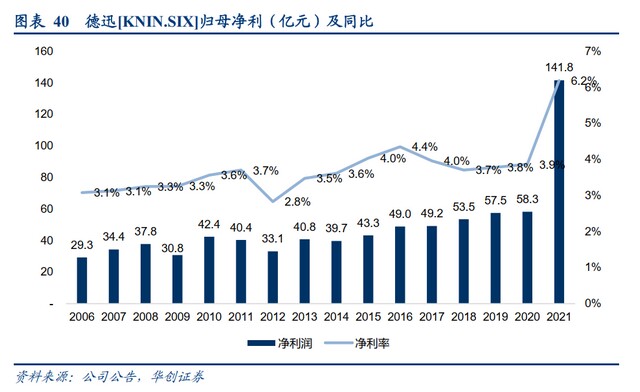

Operating revenue: in 2021, Dexun's revenue was about 228.9 billion yuan, a year-on-year increase of 51.7%; CAGR is 7.8% from 2012 to 2021;

Gross profit: in 2021, the gross profit is 69.1 billion yuan, corresponding to 30% of the gross profit rate.

Net profit attributable to the parent company: in 2021, the net profit attributable to the parent company will be about RMB 14.18 billion, with a year-on-year increase of 143.1% and a net interest rate of 6.2%; The CAGR from 2012 to 2021 is 17.5%.

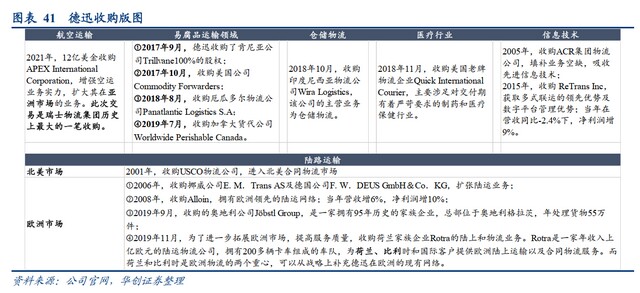

We sorted out a large number of mergers and acquisitions and strategic cooperation between Dexun in horizontal and vertical fields. The company mainly deployed in land transportation, perishable goods transportation, warehousing and logistics, medical industry, information technology and air transportation, and gradually expanded from Europe to North America, South America, Asia and other markets.

Key M & A projects are as follows:

In 2015, it acquired retransmission Inc to gain the leading advantages of multimodal transport and digital platform management; In that year, the net profit increased by 9% under the year-on-year revenue of -2.4%.

In july2019, Dexun acquired the Canadian freight forwarding company worldwide perishable Canada (WWP). Founded in 1999, WWP is one of the largest freight forwarding companies in Canada and the top manufacturer of perishable goods in the world. It is a market leader in tuna export and has a strong market on the east coast of Canada. After the acquisition, Dexun strengthened its transportation network in Canada and its air transportation services in North America.

In november2019, in order to further expand the European market and improve service quality, it acquired the land and logistics business of the Dutch family business rotra. Rotra is a land transportation and logistics company with an annual revenue of more than 100 million euros. It has a fleet of more than 200 trucks and provides European land transportation and contract logistics services for Dutch, Belgian and international customers. The Netherlands and Belgium are the two focuses of European logistics, which can strategically supplement the existing network of Dexun in Europe.

In 2021, apex International Corporation was acquired with us $1.2 billion to strengthen its air transportation business and expand its business in the Asian market. This transaction is the largest acquisition in the history of Swiss logistics group. Apex ranks 7th in the global air freight forwarder, 20th in the global freight forwarder and 5th in China freight forwarder in 2020.

2、DSV

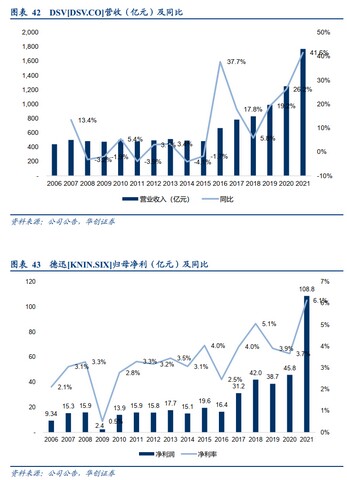

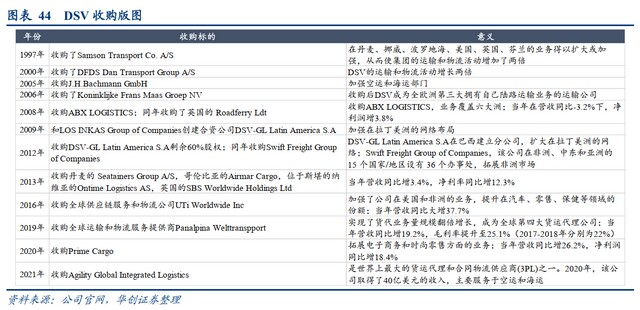

The company was established in 1976 by nine independent Danish truck transport companies and commercial developer Leif tullberg. In 1987, it was listed on the Copenhagen Stock Exchange in Denmark. Currently, the company is a global transportation and logistics service provider, with offices and related facilities in more than 90 countries on six continents, providing and operating supply chain solutions.

Operating revenue: in 2021, DSV's revenue was about 175billion yuan, with a year-on-year increase of 59% under the statistical caliber of the original currency; CAGR is 15% from 2012 to 2021;

Gross profit: the gross profit in 2021 is 36.1 billion yuan, corresponding to a gross profit margin of about 21%. The sea freight volume is 2.494 million TEU, and the unit gross profit is about 4126 yuan; The air transportation volume is 1.51 million tons, and the unit gross profit is about 8293 yuan.

Net profit attributable to the parent company: in 2021, the net profit attributable to the parent company will be about 10.9 billion yuan, with a year-on-year increase of 164% and a net interest rate of 6.2% under the statistical caliber of the original currency; The CAGR in 2012-2021 is 24%.

The company's acquisition and merger process also expanded in business areas and business scope:

In terms of business areas, it expanded land transportation, sea transportation, air transportation, e-commerce and fashion retail through acquisition;

In terms of business scope, it started from Denmark, expanded to the entire European market, and then expanded to other regions, covering six continents.

In 2006, it acquired Koninklijke Frans Maas groep NV, thus becoming the third largest transportation company in Europe with its own land transportation business;

In 2008, it acquired ABX logistics, covering six continents; In the same year, it acquired roadferry ldt; In the current year, the net profit increased by 3.8% under the year-on-year revenue of -3.2%;

In 2012, it acquired the remaining 60% equity of dsv-gl Latin America S.A, established a branch in Brazil and expanded its network in Latin America; In the same year, it acquired swift freight group of companies, which has 36 offices in 15 countries / regions in Africa, the Middle East and Asia to expand the African market;

In 2016, it acquired UTI worldwide Inc, a global supply chain service and logistics company, which strengthened the company's business in the United States and Africa and increased its share in automotive, retail, health care and other fields; The year-on-year revenue increased by 37.7%;

In 2019, it acquired Panalpina welttransport, a global transportation and logistics service provider, which doubled the scale of freight forwarding business and became the fourth largest freight forwarding company in the world; The year-on-year revenue increased by 19.2% and the gross profit margin increased to 25.1% (22.2% and 22.1% in 2017-2018 respectively).

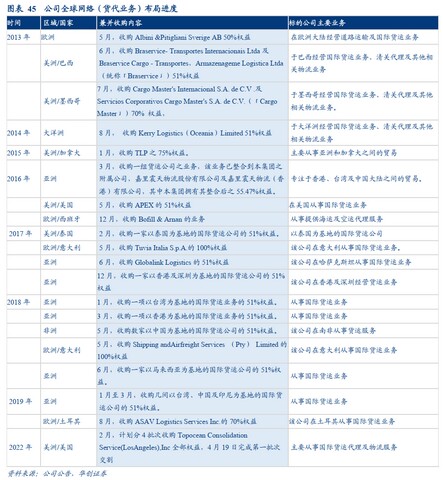

3. Kerry Logistics

Kerry Logistics ranks 8th in the list of shipping and 13th in the list of air freight among the "top 50 global freight forwarders in 2021" released by a&a joint transport topics; According to the evaluation of China International Freight Forwarders Association, in 2021, the air transport business revenue in mainland China ranked fifth, the sea transport business revenue ranked thirteenth, the land transport business revenue ranked eighteenth, the total operating revenue ranked ninth, and the warehousing business ranked eighth. Kerry Logistics has offices in 58 countries and regions around the world, and has established bases in half of the world's emerging markets, covering major international logistics hubs.

The company has shaped its global network layout and facilities through mergers and acquisitions. At present, its business covers 58 countries and regions around the world, covers major economies in the world, operates more than 69million square feet (equivalent to 6.41 million square meters) of logistics centers and facilities, and has more than 51000 employees worldwide.

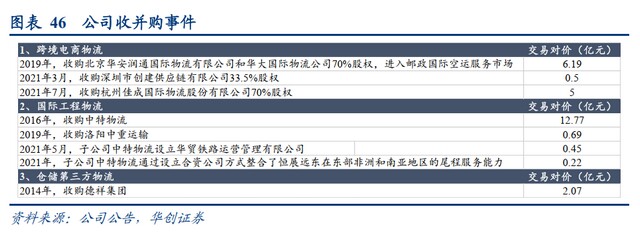

(2) Expansion of business territory by acquisition and merger of Huamao Logistics

Since its establishment in 1984, Huamao logistics has gradually expanded its business territory:

It has successively acquired Dexiang logistics, ZHONGTE logistics, Hua'an Runtong, Huada international, Luoyang Zhongzhong and Jiacheng international, successfully expanded customs supervised warehousing logistics, special logistics, international engineering logistics, postal air transport, cross-border e-commerce logistics and other fields on the basis of the original freight forwarding business, and entered the field of medical logistics through the preparation of the company.

The company accelerated its strategic layout through capital collection and M & A, improved the third-party international comprehensive logistics service capability, and basically formed a competitive strength covering the whole industrial chain.

From the perspective of profit contribution, the company disclosed that four important acquisitions (non wholly owned subsidiaries) Dexiang, Hua'an Runtong, Huada international and Hangzhou Jiacheng contributed RMB 130million and 150million respectively to the net profit attributable to the parent company in 2020-21, accounting for 25% and 18% of the net profit attributable to the parent company of Huamao logistics. It is expected that more contributions will be made with the further promotion of resource integration and coordination.

1. Cross border e-commerce logistics

In 2019, the company purchased 70% equity of Beijing Hua'an Runtong International Logistics Co., Ltd. and 70% equity of Huada International Logistics Co., Ltd. at a transaction consideration of RMB 619million, and entered the postal international air transport service market. Note: Huada International Logistics Co., Ltd. was acquired through Hong Kong Huamao, a subsidiary of the company.

In March, 2021, the company invested 50.25 million yuan to acquire 33.5% of the equity of Shenzhen shenchuang supply chain Co., Ltd., acquire the advantageous resources in cross-border logistics and customs clearance, carry out 9610, 9710, 9810 export, 1210 import and export, 9610 return and other businesses, and form a closed-loop service system of "getting out, getting in, and getting back" for e-commerce goods;

In July, 2021, the company purchased 70% of the equity of Hangzhou Jiacheng International Logistics Co., Ltd. for a consideration of RMB 500million to further layout the cross-border e-commerce full link transportation field.

Among them, the commitments for the acquisition of Jiacheng logistics are as follows: the net profits of the subject enterprise after deducting non-profit from 2021 to 2023 are 48million yuan, 65million yuan and 82million yuan respectively, corresponding to the growth rates of 35% and 26% in 22-23 years respectively; The number of overseas sites or overseas warehouses (holding or holding enterprises) shall not be less than 10 (by the end of 2021), 15 (by the end of 2022) and 20 (by the end of 2023).

Jiacheng logistics achieved a net profit of 48.28 million yuan in 2021.

Through capital integration, the company's strategic layout in the field of cross-border e-commerce logistics has begun to take shape. The business service objects include postal service, cross-border e-commerce platforms and seller customers. The service capabilities include front-end goods solicitation, transshipment and distribution, export customs declaration, trunk transportation, import customs clearance, overseas warehouse distribution, and the ability to integrate the final delivery. The service products include postal parcels, FBA special lines, international express, and personal express.

2. Engineering Logistics

ZHONGTE Logistics: in 2016, the company purchased 100% equity of ZHONGTE logistics through 50% share issuance and 50% cash purchase, with a total cost of 1.277 billion yuan, opening the company's special logistics business segment. ZHONGTE logistics has the comprehensive service capabilities of power engineering logistics, project large cargo transportation, dangerous goods transportation, international shipping and warehousing and distribution. It is a leading domestic special logistics enterprise.

In 2020, Luoyang Zhongzhong acquired 60% of the equity of Luoyang Zhongzhong transportation with a transaction consideration of 69.21 million yuan. Luoyang Zhongzhong mainly focused on the machinery manufacturing field and made a breakthrough in the offshore wind power transportation business in 2021.

China trade Railway Operation Management Co., Ltd.: in May, 2021, the wholly-owned subsidiary ZHONGTE logistics invested 45million yuan to set up China trade Railway Operation Management Co., Ltd. with its partner in Chongqing western logistics park to engage in railway freight forwarding business mainly focusing on international container railway agency business and container yard service (designated yard of southbound channel), and vigorously promote domestic railway bulk material transportation Through the centralized integration of multi-party resources and professional teams, the special railway line operation and maintenance and other series of businesses create a third level of development outside the company's air and sea transportation.

ZHONGTE and hengzhan Far East joint venture: in August, 2021, the company invested 21.6 million yuan in ZHONGTE Logistics Co., Ltd., a wholly-owned subsidiary, to integrate hengzhan Far East's end service capability in East Africa and South Asia by establishing a joint venture, further expand its land transportation, customs clearance, warehousing and other resource advantages in South Asia, Africa and other regions, and assist the company in extending its engineering logistics business to the overseas end.

According to the company's announcement, the company set up an engineering logistics business center in 2021 to integrate business resources in Beijing, Shanghai, Luoyang and overseas, and coordinate the expansion of engineering logistics business at home and abroad. 136 air-cooled self provided containers are loaded on bulk cargo ships and sent to Baltimore port of the United States; The first batch of non-standard containers of "Huawei data center" equipment are loaded on bulk cargo ships and sent to Chittagong, Bangladesh, which can carry the largest offshore wind power single pile in Asia.

3. International shipping business

In 2014, the company acquired the equity of Dexiang group at a consideration of 207million yuan. Dexiang group has the fifth supervision zone (customs supervised warehouse) of Shanghai Customs of the people's Republic of China established with the approval of relevant departments, covering an area of 39000 square meters. It has a comprehensive professional logistics service capacity integrating import distribution, customs declaration, inspection, warehousing, bonded, inland container transportation and customs supervised goods transit transportation.

Dexiang logistics is one of the six logistics enterprises with import distribution qualification in Shanghai. In the franchise field of import warehousing distribution, Dexiang logistics has a market share of more than 35% at the time of acquisition.

04

New chapter of development:

The rise of China's international cross-border logistics integrated service providers

(1) Window period of transformation and upgrading: traditional international freight forwarder → international cross-border comprehensive logistics service provider

1. International freight forwarding business process

The main function of international freight forwarder is to coordinate and complete the transnational transportation of agency goods, including the import and export services of sea and air trunk resources.

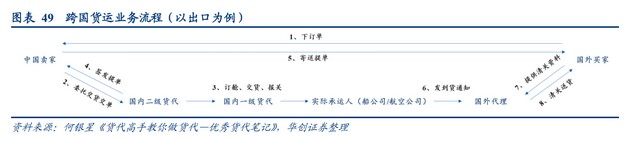

1) Taking export goods as an example, we sorted out the main processes of transnational cargo transportation:

Foreign buyers place orders with Chinese sellers;

After the Chinese seller completes the production of goods, he entrusts the freight forwarder to book the space, and provides the export declaration documents of goods;

The freight forwarding company shall book space from the shipping company / airline company, arrange the seller's designated warehouse in the cargo plane, and then the freight forwarding company shall declare customs;

The actual carrier issues the bill of lading to the freight forwarding company, forwards it to the Chinese seller, and then faxes or mails it to the foreign buyer;

The actual carrier sends the notice of arrival to the foreign agent after the goods arrive at the port, and makes customs declaration based on the customs clearance information provided by the foreign buyer. After the goods are released by the customs, they are delivered to the foreign buyer.

Domestic first-class freight forwarder: the first-class freight forwarder will directly purchase shipping space from shipping companies / airlines, and customers are mainly peers, that is, the first-class freight forwarder will purchase shipping space and resell it to the second-class freight forwarder with a certain profit. If the first-class freight forwarder can expand direct customers with sufficient and stable arrival volume, it will set up a "direct customer" sales department to develop this part of the market.

Many domestic first-class freight forwarders are the branches of foreign leading logistics enterprises in China. With the improvement of Chinese ship owners' fleet and international air logistics transportation capacity, the status of domestic first-class freight forwarders in the world has gradually improved.

Domestic second-class freight forwarder: directly connect with factories or foreign trade companies to help customers find the most appropriate mode of transportation. The secondary freight forwarder is familiar with the advantageous routes, advantageous prices, sailing time, loading and unloading capacity of the destination port and the advantageous routes of the primary agent of most shipping companies and airlines in the market, and carries out resource integration and matching.

Many first-class freight forwarders start from second-class freight forwarders. After accumulating a large number of stable customers, they have sufficient supply of goods and directly go to book space with shipping companies / airlines.

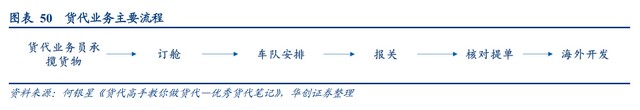

2) We take export as an example to sort out the main processes of freight forwarding business:

The freight forwarder develops the customer to contract the goods, and the driver transports the goods from the factory to the port warehouse after the production is completed;

Booking space: booking transportation space from the actual carrier and obtaining the space allocation receipt;

Fleet arrangement: ensure that the goods enter the warehouse in time when receiving the customs declaration materials, and the customs declaration can be made only after the warehouse entry checks the data;

Customs declaration: check and approve the customs declaration data, and check whether the figures on the invoice and the customs declaration form are consistent;

Check the bill of lading: the bill of lading involves the transfer of the property right relationship, so the freight forwarding company needs to cross check and communicate with the customer.

2. Window period: the upstream and downstream jointly promote the rise of China's leading freight forwarders

1) Upstream: the strength of brand going to the sea is enhanced, and a cross-border integrated logistics provider with comprehensive strength is required

China has a large number of foreign trade enterprises. In 2021, the number of foreign trade enterprises with import and export performance reached 567000, an increase of 36000 year-on-year.

The strength of leading brands going to sea has increased: in 2021, China's export to the EU and Africa grew by more than 20%, and its export to Latin America grew by more than 40%. Among them, the export of notebook computers, tablet computers, household appliances and other household economy related products and pharmaceutical materials and drugs continued to maintain a large growth.

China's cross-border e-commerce is developing rapidly overseas: cross-border e-commerce logistics has become an indispensable part of international cross-border logistics. At present, there are many independent e-commerce stations with a certain scale in China, which are competitive in the international market. In the past 8 years, Sheen has achieved an annual growth rate of more than 100% and achieved rapid development. In the first half of 2021, Sheen has become a global popular shopping application second only to Amazon.

2) Downstream: the share of domestic trunk transport capacity resources has increased, and domestic cross-border logistics has more transport resources

In terms of maritime resources: according to the data of the Ministry of transport, by 2021, China's controlled maritime fleet has a capacity of 350million deadweight tons, ranking second in the world. China has a registered crew of more than 1.8 million, with an annual average of nearly 140000 crew members dispatched abroad, both of which are among the highest in the world. Among the top 10 ports in the world in terms of cargo throughput and container throughput, China holds 8 and 7 seats respectively.

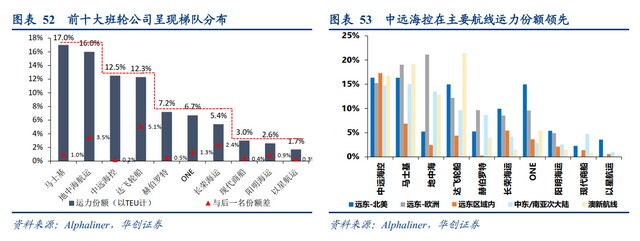

COSCO Haikong has the third largest market share in the world: according to alphaliner statistics, the first market share of Maersk is 17%, the second market share of Mediterranean is 16%, COSCO Haikong as the third market share is 12.5%, and Herbert as the fifth market share is only 7.2%. In addition, the company ranks among the top three in the industry in the Far East North America, Far East Europe, the Far East region, the Middle East / South Asia subcontinent and Australia New Zealand routes.

In terms of air transport resources: from the perspective of civil and mail transport volume of international routes, China's international air cargo volume CAGR reached 10% in the 20 years from 2001 to 2020. In 2020, the cargo and mail transportation volume of international routes will be 2.23 million tons, accounting for 33%.

3. We estimate that the freight forwarding market will be nearly 2-3 trillion yuan in 2021

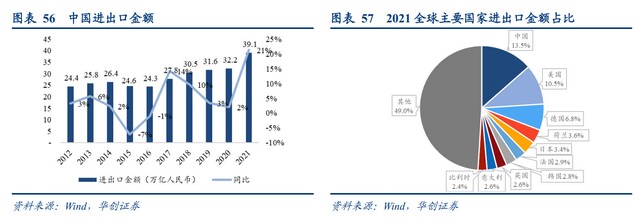

China's import and export volume ranked first in the world in 2021. In 2021, China's import and export volume reached 39.1 trillion yuan, accounting for 13.5% of the world's total, ranking first.

In terms of exports, the proportion of Chinese Mainland's exports has been increasing. In 2021, the proportion will reach 10.5%, and the export amount will reach 21.7 trillion yuan, an increase of 21.2% year-on-year.

According to the estimation that China's total logistics cost accounts for 14.6% of GDP in 2021, the logistics cost corresponding to China's import and export scale in 2021 is 571million yuan; Assuming that the cost of trunk lines accounts for 40-50% (refer to the whole process of cross-border e-commerce logistics), the corresponding scale of freight forwarding trunk lines in 2021 is about 230-290million.

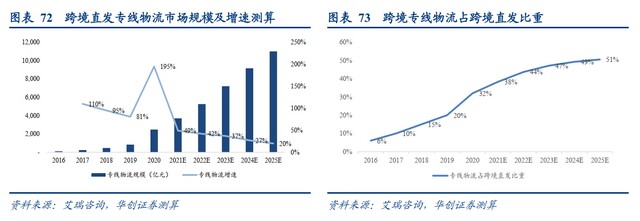

(2) Cross border e-commerce logistics: the beneficiary of cross-border e-commerce dividends

According to iResearch consulting data, the compound growth rate of cross-border export e-commerce logistics market in the past five years has reached 42%, and the scale will reach 1.3 trillion yuan in 2020, with a growth rate of 84%. At the same time, iResearch consulting predicts that the market CAGR will be about 22.5% in the next five years, and the market scale is expected to reach 3.6 trillion yuan by 2025. In 2020, the scale of China's B2C cross-border export e-commerce logistics industry reached 476.4 billion yuan, a year-on-year increase of 104%, and the scale of B2B cross-border export e-commerce logistics reached 817.1 billion yuan, a year-on-year increase of 75%.

According to the customs statistics, China's cross-border e-commerce import and export reached 1.98 trillion yuan in 2021, an increase of 15%; Among them, the export was 1.44 trillion yuan, an increase of 24.5%.

1. Cross border direct delivery and overseas warehouse are the two mainstream modes of cross-border export e-commerce logistics at present

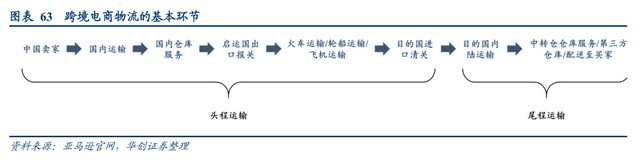

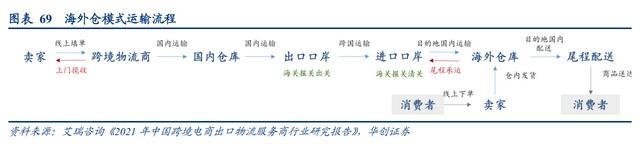

The basic links of cross-border export e-commerce logistics are as follows: Chinese sellers send goods to cross-border export e-commerce logistics collection points / cross-border e-commerce logistics collection points for door-to-door shopping - > cross-border logistics companies provide domestic transportation, warehousing and customs declaration services - > after successful customs declaration, the goods are delivered to the destination country through cooperative train, ship or aircraft transportation - > import customs clearance, domestic transportation, warehousing services, and distribution to foreign buyers in the destination country.

Among them, first trip transportation: the transportation process in which merchants transport commodities to overseas warehouses by sea, air, land or multimodal transport;

Final transportation: the transportation process in which goods are delivered to final consumers after they arrive abroad.

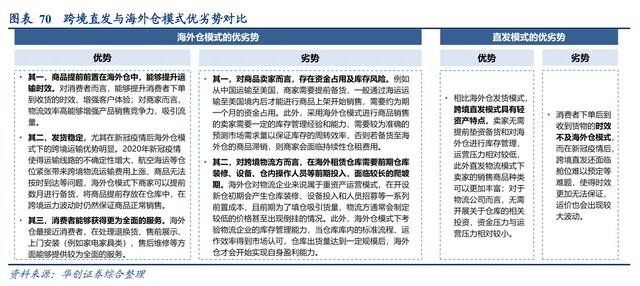

At present, China's cross-border export e-commerce logistics is mainly divided into two modes: cross-border direct delivery and overseas warehouse, accounting for about 60% and 40% respectively.

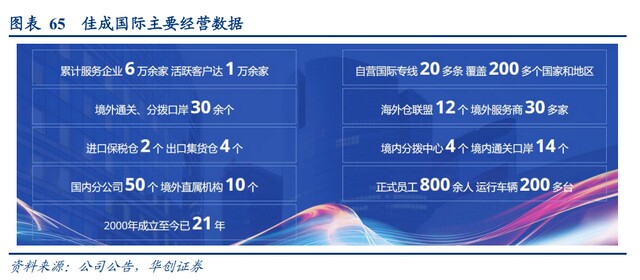

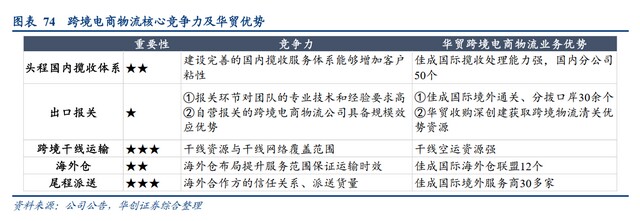

Jiacheng international, a subsidiary of Huamao, covers both cross-border direct delivery and overseas warehouse businesses, and can provide more comprehensive services to customers.

At present, Jiacheng international operates special lines and overseas warehouse business at the same time, with more than 20 self operated international special lines, covering more than 200 countries and regions; There are 12 overseas warehouse alliances and more than 30 overseas service providers.

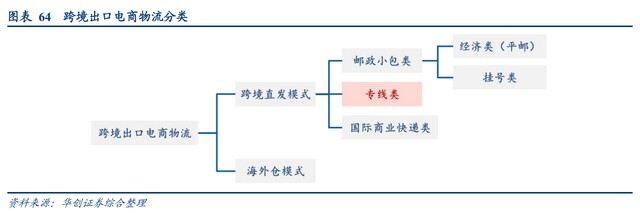

1) Cross border direct delivery: including postal service, international express delivery and cross-border special line

The cross-border direct delivery mode refers to the logistics service provider completing the whole process of door-to-door logistics of export goods. Due to the differences in package traceability, timeliness requirements and billing methods, cross-border direct logistics service products have obvious differences in product prices. E-commerce sellers can choose according to their actual transportation needs.

There are three cross-border direct delivery modes:

First, postal parcels for the export of cross-border e-commerce goods through the postal networks of all countries of the UPU;

Second, the cross-border special line service providers organize cross-border special line services by using self operated cargo collection, self scheduled flight capacity and tail end distribution;

Third, international commercial express services led by DHL, FedEx and UPS.

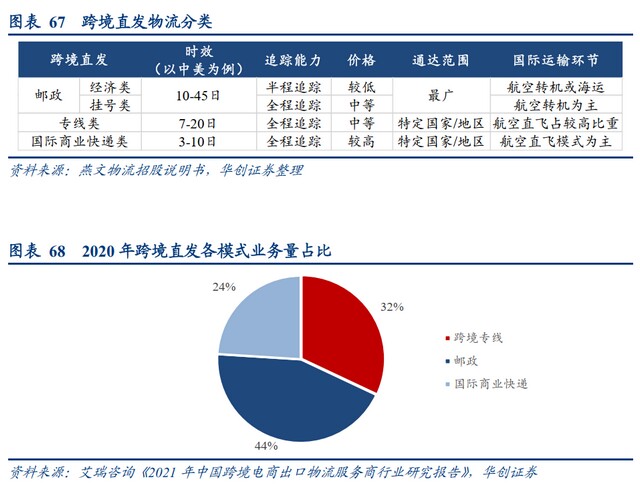

a) Postal service: it is mainly divided into two types: economic (ordinary mail) and registered mail. The advantage of postal cross-border transportation is that the price is low and the global accessibility is the widest, but the timeliness is relatively slow. Take China and the United States for example, it usually takes 10-45 days. In 2020, postal services accounted for the highest proportion of cross-border direct mail, accounting for 44%.

b) International Commercial express delivery is the fastest, but the price is also relatively high. Take China and the United States for example, it usually takes 3-10 days. In 2020, international commercial express accounts for 24% of cross-border direct delivery.

c) Special line logistics: many domestic logistics companies have found a special line transportation mode between postal service and international commercial express, which is more efficient than postal service and lower than international commercial express. Special line transportation logistics service providers form a full link integrated cross-border transportation mode by providing domestic collection, air freight booking, customs clearance and looking for the full chain service of local distributors in the last kilometer of the local area. Take China and the United States for example, usually 7-20 days. In 2020, special lines accounted for 32% of cross-border direct delivery.

2) Overseas warehouse: supplemented by cross-border direct delivery, mainly in the mode of goods preparation

The overseas warehouse is equivalent to the "front warehouse" of domestic logistics. The logistics service provider first transports the export goods to the warehouse in the destination country for "stock up". If there is a local order for relevant goods, it will be packaged in the warehouse and sent to overseas consumers by the overseas warehouse through the local logistics service provider.

Under the overseas warehouse mode, export commodities have arrived at the overseas warehouse before foreign consumers place orders. Therefore, under the overseas warehouse mode, the distribution efficiency can be improved. However, the merchants who use the overseas warehouse to prepare goods in advance need to calculate the future market demand through historical data. In order to reduce inventory risk, merchants generally choose popular products for overseas warehouse delivery.

In recent years, driven by the upgrading of China's cross-border export of electric goods and overseas consumers' demand for extreme distribution experience, the overseas warehouse model has developed rapidly. The cross-border e-commerce platform realizes the performance and storage functions of E-Commerce orders through the use of third-party overseas warehouses, self operated overseas warehouses and other storage resources, reducing consumers' waiting for long-term first and intermediate cross-border transportation.

3) It is expected that cross-border direct issuance and overseas warehouse will complement each other in the future

For many businesses, there are both their own popular products and new products launched continuously. Generally speaking, the sales of popular products are stable. Businesses have some experience in inventory and order management. Therefore, they will choose overseas warehouse delivery to enhance consumption stickiness. As for new products, SKUs are very abundant, and the cost of placing them in overseas warehouses is high and uncertain. Therefore, businesses will choose cross-border direct distribution to reduce their own risks.

2. The logistics of cross-border direct lines shows a trend of rapid growth

Cross border special line logistics is between Postal and commercial express in terms of timeliness and price. It has the characteristics of meeting the timeliness needs of domestic cross-border e-commerce and providing cost-effective logistics services. It has shown a rapid growth trend in the past five years.

1) Logistics development background of cross-border direct lines

At the early stage of industry development, China Post and international commercial Express were mainly used to undertake domestic cross-border logistics demand. The Universal Postal Union (UPU) made a series of adjustments to the terminal fees of destination countries in 2016. In 2019, the third special assembly of UPU considered and approved the reform plan of international terminal fees. The meeting decided that the terminal fees of the third group of countries to which China belongs would increase by 27% in 2020. According to the news briefing of the State Post Office on October 14, 2019, the terminal fees of international packets exported from 2020 to 2025 will increase by 164% compared with 2019, This will push up the cost of cross-border e-commerce logistics of China's postal service.